Designing a Winning Compensation Strategy for Business Success

Attracting and keeping top talent is not easy because today's job market is extremely competitive.

But you probably already know this.

Companies like yours work hard to find the balance between offering competitive compensation packages and ensuring financial sustainability.

If you're struggling to design a strong compensation strategy that is fair and competitive, you've come to the right place.

This article will explore:

Why you need an effective compensation strategy

The pillars of a successful compensation strategy

6 key strategies for designing an effective compensation strategy

The legal and compliance considerations when building a compensation strategy

Let’s get right to the point with this question.

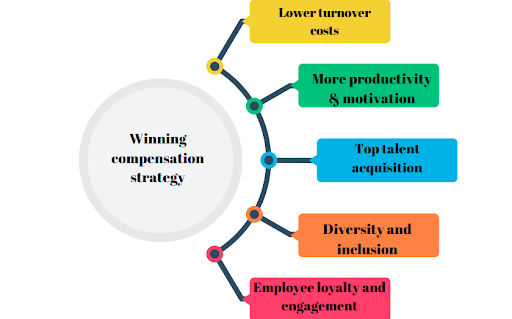

Why You Need an Effective Compensation Strategy

An effective compensation strategy is crucial for the long-term success of any organization. It’s not just about attracting top talent. A well-rounded approach enhances employee engagement, retention, and productivity.

Here's why implementing such a strategy is essential:

Reduces Turnover Costs

Employee turnover is expensive. The Work Institute's 2020 Retention Report estimates that replacing an employee can cost approximately 33% of their annual salary. For instance, replacing an employee earning $60,000 could cost around $20,000. High turnover affects finances, disrupts team dynamics, and reduces productivity.

Boosts Productivity and Motivation

Research from the University of Warwick indicates that happier employees are about 12% more productive. A well-executed compensation strategy that aligns with employee performance fosters motivation and engagement, leading to better outcomes and a more committed workforce.

Attracts Top Talent in a Competitive Job Market

According to Glassdoor, 67% of job seekers consider salary and compensation as top factors when accepting a job offer. In a competitive job market, companies offering strategic compensation packages are better positioned to attract skilled professionals and maintain an edge over competitors.

Supports Diversity and Inclusion Efforts

McKinsey's research shows that companies in the top quartile for gender diversity on executive teams are 25% more likely to have above-average profitability. Ensuring fair compensation helps attract a diverse workforce and fosters an inclusive company culture, which in turn contributes to improved financial performance.

Enhances Employee Loyalty and Engagement

The Society for Human Resource Management (SHRM) reports that effective communication of compensation strategies can increase employee retention. Transparent and fair compensation practices build trust, encouraging employees to invest more in their roles and contributing to long-term organizational growth.

The Pillars of a Winning Compensation Strategy

A strong compensation strategy is essential for attracting, retaining, and motivating employees. It hinges on several key pillars that ensure competitiveness, equity, and alignment with organizational culture and goals. Here’s a breakdown of these core pillars:

Market competitiveness: Compensation must be competitive to attract and retain talent. And you’ll need to do lots of regular market analysis and benchmarking against industry standards and regional norms to ensure attractive and fair pay scales. You must also gather data on competitor compensation structures and adjust their offerings accordingly. Focus mainly on direct compensation, base salaries, and performance bonuses.

Internal equity: Ensuring fairness within the organization means establishing clear, consistent criteria for pay levels across similar roles and responsibilities. You’ll also need a transparent compensation philosophy for evaluating job positions, considering factors like experience, education, and performance. Internal equity prevents disparities that can lead to dissatisfaction and turnover.

Performance alignment: Compensation should be directly tied to individual and company performance. This involves creating measurable and achievable goals and rewarding employees who meet or exceed these targets. Performance-based incentives, such as bonuses or stock options, motivate employees to contribute to the company’s success. This pillar demands a clear, objective performance appraisal system that is regularly reviewed and updated.

Flexibility and adaptability: A flexible compensation approach can adapt to changing market conditions, business needs, and employee demographics. This may include offering comprehensive benefits packages, remote work allowances, or career development opportunities. Flexibility helps meet diverse employee needs and preferences, enhancing satisfaction and loyalty.

Legal compliance and transparency: Adhering to legal standards and regulations governing compensation is non-negotiable. This includes compliance with minimum wage laws, overtime pay, and benefits requirements. Legal compliance and transparency about how compensation structures are made build trust and reinforce the perception of fairness.

Sustainability: Your compensation strategy must be financially sustainable for the organization. It should align with your company’s long-term financial planning, ensuring that pay structures are maintainable without jeopardizing its financial health.

6 Key Strategies for Designing a Winning Compensation Strategy

Now, let’s see what a winning plan looks like. We did our research, and here are the best steps you can follow to make sure your compensation strategy helps you reach your business goals. Of course, each situation is unique and you should be prepared to adapt these steps according to your internal situation.

Let’s start.

1) Align Compensation with Business Goals and Strategy

Aligning compensation with business goals and strategy ensures that your pay structure directly supports achieving your company’s objectives. Here’s how to leverage this strategy effectively:

Begin by clearly defining your business goals. Understanding your targets is essential, whether it's growth, innovation, customer satisfaction, or market expansion.

Next, develop a performance-based compensation program in which rewards are directly tied to individual, team, or company performance relative to your objectives. This will encourage behaviors that align with your goals.

Pro tip: We recommend performance management tools like 15Five, BambooHR, or SAP SuccessFactors because they can genuinely streamline employee performance tracking. Therefore, it’s way easier to connect compensation directly to results.

And, of course, review and adjust your compensation approach on a yearly basis. The point is to ensure it remains aligned with any shifts in your business strategy or goals. The business environment is dynamic; your compensation strategy should be, too.

Here, we recommend compensation planning tools like Payscale or CompAnalyst, which have data-driven insights and benchmarking capabilities. These can keep your compensation strategy highly adaptable, which is what you’re aiming for ultimately.

Google’s compensation strategy is a textbook example of aligning pay with business strategy. Google emphasizes innovation and growth, and its compensation program reflects this by heavily rewarding innovation through performance bonuses and equity awards.

This approach attracts top talent and motivates employees to contribute to the company's primary innovation objective.

And we can’t help but notice the results speak for themselves, with Google consistently being among the top companies for innovation and employee satisfaction.

2) Ensure Market Competitiveness

Ensuring market rate competitiveness in your compensation strategy means your pay structure is attractive compared to others in the industry. This is key to attracting and retaining top talent who want to be paid their worth.

Here's how to do this effectively:

First, conduct regular salary surveys. Stay informed about industry salary trends by participating in or purchasing comprehensive salary surveys. This ensures your pay scales are competitive within your sector and geographical area.

Your HR department should be doing this quite regularly.

Next, identify benchmark roles within your organization that are critical to your business success. Compare these roles against similar positions in the industry to ensure your compensation structure is competitive.

Netflix’s approach to compensation structures is another prime example. Netflix pays what it believes to be the top of the market for its employees based on their skills, capabilities, and the market demand for their roles. This strategy has made Netflix a desirable workplace and helped it attract and retain top talent in a competitive job market.

Remember: Netflix's philosophy is that high performance comes from being excited about your company and knowing you’re compensated well. By paying top of the market, Netflix ensures it’s a magnet for industry-leading talent and maintains its competitive edge.

But there’s arguably a more important thing to consider: total compensation. Look beyond base salary. Ensure your total compensation package, including bonuses, benefits, and perks, is competitive.

For example, you may not have the budget for higher salaries, but you can afford to enroll people in classes and courses they’re interested in or to get them more vacation time.

In an advertising agency, this could mean access to vertical or horizontal development, including offering SEO courses to paid media strategists or creative design courses to SEOs.

3) Promote Pay Equity and Transparency

Promoting pay equity and transparency fosters a culture of trust and fairness. And you need that to attract and retain good talent. You already took the first step in the previous section when you started reviewing and adjusting pay structures. But you need to do this quite regularly to ensure they're equitable across all roles, levels, and demographics within your organization.

Remember: Address any disparities promptly and be transparent about pay practices.

Share your methodology for determining pay scales, salary ranges, raises, and performance bonuses. Transparency about how compensation is structured and awarded builds trust.

We recommend using platforms like Compt and Zenefits to manage and communicate compensation plans effectively, ensuring transparency with employees.

As a quick side note, we especially appreciate Compt for small businesses because it’s extremely affordable and easy to use.

But don’t take our word for it, and do your own research.

The final step is to implement clear progression pathways.

Ensure employees understand how they can progress within the organization and what that means for their compensation. Clear pathways for advancement support motivation and retention.

If you want an example spotlight, look at Salesforce’s approach to pay equity.

The company undertook a comprehensive review of its employees' pay and adjusted salaries to address any gender pay gaps, committing millions of dollars to this effort. Salesforce continues to conduct annual pay audits to ensure ongoing equity, demonstrating a commitment to fairness that boosts its reputation, employee satisfaction, and loyalty.

The video below has more valuable info about this – we promise you have lots to learn from it!

4) Incorporate Performance-Based Incentives

Incorporating performance-based incentives into your compensation strategy can significantly enhance your organization's productivity and employee motivation. At the end of the day, everyone wants to be recognized for the work they bring to the table.

But first, ensure performance metrics are clear, attainable, and directly tied to business objectives. This clarity helps employees understand how their efforts contribute to the company's success.

The criteria for earning performance bonuses should also be transparent and consistently applied. This fosters a sense of fairness and encourages healthy competition.

People also need you to provide regular feedback on performance relative to incentives. This motivates employees and allows you to make timely adjustments to goals and rewards as necessary.

We love Zappos here because it has implemented a unique mix of incentives, including a "pay to quit" program to ensure employees stay because they genuinely want to.

Additionally, Zappos maintains a flat employee hierarchy, allowing for peer recognition and awarding a monthly "hero" for standout performance, complete with various minor perks. This approach demonstrates how a variety of incentives can create a comprehensive program that boosts employee satisfaction and engagement.

And we couldn’t help but include another clip showcasing their strategy.

5) Offer Flexible and Comprehensive Benefits

Offering flexible and comprehensive benefits packages as part of your compensation program is crucial for attracting and retaining a diverse workforce. We already mentioned this strategy above, but we think it’s so important that it warrants its own section.

Well, here are some practical steps to implement it.

First, understand that employees value different benefits at various stages of their lives and careers. Offer multiple options, such as health insurance, retirement plans, parental leave, and flexible working arrangements, to appeal to a broad spectrum of employees.

For example, employees with young kids might appreciate daycare options, especially within your premises. Others might love flexible working arrangements or more learning opportunities to develop new skills.

It’s also wise to incorporate benefits that promote a healthy work-life balance, such as flexible work hours and remote work. This can improve job satisfaction and productivity tremendously. In fact, 65% of people manage workloads and stress better when they work from home.

Dolby stands out as an example of offering flexible and comprehensive benefits packages. Employees at Dolby get every other Friday off, a program focusing on physical, emotional, financial, and community well-being and a flexible work model.

You can read about their other benefits on their homepage:

And it’s wise to ensure employees understand the full value of their benefits package. You can use tools like Benify or Benefitfocus to create total compensation statements and communicate benefits clearly.

6) Implement Regular Reviews and Adjustments for Inflation or Market Changes

We’re big fans of regular reviews and adjustments in 99.99% of cases. In this situation, it’s great to adjust for inflation and market changes if you want to maintain a competitive edge and also ensure employee satisfaction and retention.

After all, you want your compensation strategy to remain relevant and responsive to external economic factors and internal performance metrics. To start, establish a review cadence. Annual reviews are common, but consider more frequent reviews if your industry experiences rapid market changes or is in a high-growth phase.

Base your adjustments on robust data, including inflation rates, industry compensation surveys, and regional cost of living adjustments. This ensures that your compensation packages remain competitive and fair.

And don’t forget to involve stakeholders. In the review process, engage with human resources, managers, and department heads to gather insights on performance trends and market demands. This collaborative approach ensures that compensation adjustments are aligned with actual team and individual performance.

Patagonia, an outdoor clothing and gear retailer, exemplifies how regular reviews and adjustments for inflation and market changes can substantially benefit a company's compensation strategy.

Patagonia regularly assesses the broader economic environment, including inflation rates and cost-of-living adjustments, to ensure that its compensation packages remain competitive and fair.

After all, as Patagonia’s founder, Yvon Chouinard, would say:

Legal Considerations and Compliance

Designing a compensation strategy is not just about offering benefits. You need a meticulous understanding of legal and compliance considerations to ensure fairness, competitiveness, and legality.

Let's explore some of the key considerations below:

Minimum Wage Compliance

Employers must comply with federal, state, and, in some cases, local minimum wage laws. These laws establish the lowest hourly rate an employer can pay an employee. Violating minimum wage laws can result in severe penalties, including fines and back pay.

In fiscal year 2024, the U.S. Department of Labor's Wage and Hour Division recovered more than $202 million in back wages for nearly 152,000 workers. Basically, not following the rules means paying the penalties later on.

Equity in Pay

The Equal Pay Act requires that men and women in the same workplace be given equal pay for equal work. The jobs need not be identical, but they must be substantially equal. It is illegal to pay different wages based on gender for jobs requiring the same skill, effort, and responsibility.

In fact, the U.S. Equal Employment Opportunity Commission (EEOC) resolved 165 merits lawsuits and filed 93 lawsuits alleging discrimination in fiscal year 2020, recovering over $106 million for affected individuals.

Overtime Regulations

The Fair Labor Standards Act (FLSA) mandates that non-exempt employees receive overtime pay for hours worked over 40 in a workweek at a rate not less than time and one-half their regular pay rates.

Warning: Misclassifying employees as exempt from overtime can lead to legal challenges.

Anti-discrimination Laws

Compensation strategies must comply with laws prohibiting workplace discrimination. This includes the Civil Rights Act, the Americans with Disabilities Act, and the Age Discrimination in Employment Act, ensuring that compensation practices do not discriminate based on race, color, religion, sex, national origin, disability, or age.

Tax Obligations

Employers must withhold the appropriate taxes from their employees' wages, including federal and state income taxes and Social Security and Medicare taxes. Failure to comply with tax withholding requirements can lead to penalties and interest charges.

Benefits Compliance

When offering benefits such as health insurance, retirement plans, and paid time off, employers must adhere to relevant laws and regulations, such as the Affordable Care Act and the Employee Retirement Income Security Act (ERISA). Compliance ensures that benefits are provided fairly and according to legal standards.

Remember: In short, a legally compliant compensation strategy is non-negotiable and requires diligent adherence to a complex web of federal, state, and local laws. To navigate the evolving legal context effectively, consult your legal and HR professionals in these compensation-related decisions.

Build a Better Compensation Strategy This Year

In this article, we explored the essential steps and considerations needed to create a compensation strategy that is fair to your employees and competitive in the market. We highlighted the importance of understanding market rate standards, employee expectations, and your business's financial capabilities.

To design a successful compensation strategy, start by researching what others in your industry are offering. Then, ensure your plan is flexible enough to adapt to changes in the competitive job market and your company's needs, keeping fairness and competitiveness at the core.

Remember, a well-thought-out compensation strategy can be a game changer for your business.

Leverage the insights we shared here to craft a plan that attracts and retains top talent. It’s what will ultimately set your business up for organizational success.

Frequently asked questions

What is meant by compensation strategy?

A compensation strategy is a structured approach that companies use to determine how to reward employees for their work, including salaries, benefits, incentives, and bonuses. It aims to attract, retain, and motivate employees while aligning compensation with the organization’s goals, budget, and competitive landscape.

What is an example of a compensation strategy?

Examples of compensation strategies vary widely depending on a company’s goals. Common strategies include:

Straight salary: A fixed salary paid regardless of performance.

Salary and commission: A base salary plus additional earnings based on sales or performance.

Commission only: Earnings are fully performance-based, with pay solely from commissions.

Team commissions: A shared commission structure based on team performance rather than individual sales.

Profit margin or revenue-based: Compensation tied to the company’s profit margin or revenue targets.

Residual commission: Ongoing commissions for repeat sales or long-term customer accounts.

What are the three main types of compensation strategies?

Three primary types of compensation include:

Direct compensation: Salaries, wages, commissions, and bonuses paid directly to employees.

Indirect compensation: Non-cash benefits such as health insurance, retirement plans, and paid time off.

Non-monetary compensation: Opportunities for career development, work-life balance, recognition, and positive workplace culture.

Companies should assess their budgets, strategic goals, employee demographics, and geographic locations when choosing the right compensation approach.

What are the 3 P’s of compensation?

The 3 P’s of compensation are:

Pay for position (P1): Compensation aligned with the responsibilities of the job role.

Pay for person (P2): Compensation based on the individual’s skills, qualifications, and capacity within their role.

Pay for performance (P3): Compensation tied to the results and achievements of the individual.

The 3P Salary system balances these factors to ensure fair, competitive, and motivating pay structures.

How to create a compensation strategy?

Creating a compensation strategy involves defining company objectives, analyzing industry standards, and considering the needs and motivations of your workforce. Begin by assessing your budget, workforce location, and desired outcomes, and then choose a pay structure (e.g., performance-based, market-based). Further tailor the strategy with benefits, bonuses, and incentives that align with your organization's goals.

What are the 4 perspectives of compensation?

The four perspectives to consider when crafting a compensation strategy are:

Internal equity: Ensuring fair and consistent compensation across similar roles within the organization.

External competitiveness: Offering pay that is competitive with similar roles in the market to attract top talent.

Employee contributions: Recognizing and rewarding individual and team achievements and contributions.

Administrative efficiency: Creating a compensation plan that is easy to manage, cost-effective, and scalable with company growth.