Insurance Industry by the Numbers: Stats, Insights, & Analysis

The insurance industry is a foundational element of global economic stability. It enhances risk management, customer service, and strategic foresight across sectors.

This article dives into the latest statistics and insights that paint a detailed picture of this essential industry.

We’ll explore:

Key stats about the insurance industry as a whole

The adoption of new technologies in the insurance industry

Insights about insurance industry challenges

This analysis aims to empower industry professionals and stakeholders like you with the knowledge required to thrive in an increasingly complex environment. Keep reading to bridge the gap between data and practical application.

Insurance Industry Overview

Did you know that in 2022, the total global insurance premium income amounted to approximately $6.048 trillion?

This figure reflects the industry's enormous scale, which encompasses life, property, casualty, and health segments. It shows the significant financial flows within the global economy facilitated by insurance activities.

Let's take a look at some more key insurance industry stats below.

Mergers and Acquisitions: The insurance sector saw 449 M&A deals globally in 2022. This is the highest number in a decade. And it signals a large interest in consolidation and expansion despite economic fluctuations.

Investment Strategies: As traditional revenue streams become less lucrative, the industry is shifting toward investment alpha. Insurers increasingly focus on high-yield assets to gain a competitive edge.

Market Distribution Changes: The rise of independent third-party distributors is reshaping market dynamics. In the U.S., these distributors' market share increased from 49% in 2010 to an estimated 55% in 2021. Therefore, this reflects a move away from proprietary networks.

Regional Growth Variances: North America led property and casualty (P&C) insurance growth in 2022, contributing more than half of the global premium increase. This region remains the largest market. That shows us its critical role in the worldwide insurance landscape.

Life Insurance Sector Struggles: The life insurance market declined, especially in Western Europe, where premium income dropped by 2.7% in 2022. This trend highlights the challenges faced in more mature markets amid economic pressures.

Health Insurance Dominance in the U.S.: In the health insurance sector, the U.S. commands about two-thirds of all premium income globally. This is another indicator of its significant impact on the worldwide insurance economy.

Inflation and Economic Cycles: The insurance industry plays a key role during economic downturns by buffering against inflation. Therefore, it can significantly alter premium rates and market dynamics over time.

Technological Impact and Adaptation: Insurers adapt to technological advancements to stay competitive. Integrating digital tools is crucial for sustaining growth and expanding into new markets.

Future Outlook on Premiums: Insurance premiums are projected to rise by 5.2% over the next decade, adding significantly to the global premium pool and shaping future strategic decisions.

Employment numbers: The U.S. life and health insurance sector alone employed approximately 912,300 individuals in 2023, indicating its significant role in the job market.

Private Investment: Private capital–backed platforms in the U.S. now control about 9% of the industry's general account reserves. This number points to a significant shift towards private investment in the insurance sector.

Adoption of New Technologies in the Insurance Industry

The insurance industry is undergoing a significant transformation. And this transformation has been spearheaded by technological advancements. Here are some of the latest statistics and trends that paint a better picture here:

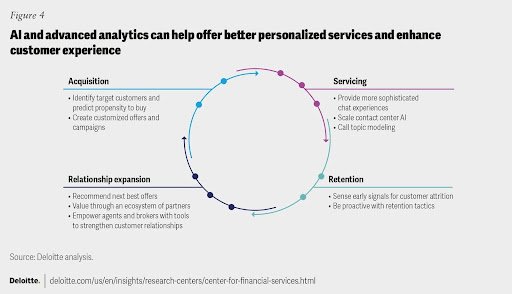

Artificial Intelligence (AI) and Automation: AI is becoming a central strategy across the insurance value chain. And AI enhances both customer-facing and operational aspects. The strategic deployment of AI is transforming a slew of processes. Think risk assessment, customer service, claims management, and underwriting. Besides, predictive analytics is playing a highly important role in improving efficiency and customer engagement.

Cloud Adoption and Digital Transformation: There is an increased movement towards cloud technology. The insurance sector sees plenty of benefits from this, too. For example, this shift enhances operational flexibility. Plus, it supports the rapid deployment of new applications and services. Therefore, it’s basically accelerating digital transformation across the industry.

Internet of Things (IoT) and Telematics: Integrating IoT and telematics is propelling risk assessment and management advancements. And that’s another major trend. Collecting and analyzing real-time data lets insurers offer personalized insurance products, keeping more clients happy. Plus, they can adjust premiums based on actual usage and behavior.

Blockchain Technology: The adoption of blockchain is improving transparency and security within the industry. This technology underpins the credibility of transactions and data exchanges. And credibility is essential for claims processing, fraud prevention, and enhancing customer trust.

Custom Insurance Apps and Portals: Insurers focus on improving user experience through customized apps and customer portals. These platforms offer enhanced accessibility, automated workflows, and real-time data processing. Again, all of these are critical for maintaining your competitive edge and customer satisfaction.

Predictive Analytics: Leveraging large datasets via predictive analytics, insurers can tailor policies and identify risks. As a result, they can significantly enhance personalized marketing and risk management strategies. So, they ultimately do a better job for their customers.

As you can see, all these advancements signify a broader industry pivot towards a more integrated, efficient, and customer-centered approach.

Insurance Industry Challenges

The insurance industry faces several significant challenges in 2024, driven by regulatory, technological, and market dynamics.

Let’s review them so you can be better prepared.

Cybersecurity and Data Breaches: The frequency and severity of cyber threats, including data breaches and ransomware attacks, have escalated. For you and other insurers, that means you need more robust cybersecurity measures. As a result, the industry is expected to increase its investment in cybersecurity to mitigate these risks.

Regulatory Compliance: Regulatory environments are becoming more stringent, particularly when it comes to artificial intelligence and data privacy. For instance, there are new frameworks being implemented in Colorado, which aim to prevent bias in AI models used by insurers. The industry must adapt to these changes while also balancing innovation and compliance. No pressure.

Climate Change and Natural Disasters: The impact of climate change continues to grow. Therefore, insurers need to adapt their policies to the increasing frequency and severity of natural disasters. This involves reevaluating risk models and enhancing data analytics; that’s how you can make better predictions and mitigate these risks.

Economic Volatility and Market Instability: The insurance industry must navigate the complexities of a volatile economic landscape. Basically, you’re dealing with fluctuating interest rates and recessionary pressures. These factors influence consumer behavior and can also affect the profitability and liquidity of insurance firms. To mitigate these risks, you need solid strategic planning.

Talent Management and Succession Planning: A significant portion of the insurance workforce is approaching retirement. That’s why there is an urgent need for effective talent management strategies. One solution is that insurers are increasingly relying on AI to automate routine tasks. But AI can’t do everything. Insurers also need to focus on upskilling their workforce to handle more complex roles and maintain innovation within the industry.

Evolving Consumer Expectations: As digital transformation accelerates, consumer expectations for seamless, digital-first interactions are rising. Insurers are pressed to enhance their digital offerings and improve customer service to meet these expectations. That’s how they can stay competitive , after all.

Mergers and Acquisitions: The sector may see increased M&A activity. The fact is companies seek strategic advantages through acquisitions. And they’re particularly targeting insurtech firms to leverage their technological capabilities.

All these challenges require insurers to be agile, innovative, and forward-thinking to sustain growth and maintain competitiveness.

What’s Next for the Insurance Industry?

This analysis unpacked the numbers driving the insurance industry alongside notable trends and detailed insights. We have examined shifts in market dynamics, policy evolution, and technological integration to give you a clearer picture.

But you need to pay attention and stay proactive.

With the risk of stating the obvious, the insurance sector is undergoing rapid transformation. Traditional business models are being revamped with digital technologies and data analytics. And this paves the way for more responsive strategies.

So, use this data when you consider future strategies within your profession. Informed decisions help you tackle these challenges and leverage opportunities for innovation in your work.