July 2025: Top 22 Insurance Recruiters, Headhunters, and Executive Search Firms

Updated: July 2025

Navigating the complex and dynamic world of insurance recruitment can be a daunting task, whether you're a company seeking top talent or a professional looking for your next career move. This industry, rich in diversity and opportunity, requires a keen understanding of both the market and the unique skills demanded by insurance roles.

The Value of Insurance Recruiters, Headhunters, and Executive Search Firms

Insurance recruiters, headhunters, and executive search firms play a pivotal role in shaping the workforce of the insurance industry. They not only possess a deep understanding of the industry's nuances but also maintain an extensive network of contacts, which is essential for finding the right fit for both employers and candidates.

These specialized firms are adept at navigating the intricate landscape of insurance roles, from underwriters and claims adjusters to high-level executives. Their expertise lies not just in matching skills to job descriptions, but in understanding the culture and strategic needs of companies, ensuring a harmonious and productive relationship between the employer and the employee.

How to Choose the Right Firm for Your Needs

Selecting the right recruitment partner is critical in the competitive and specialized field of insurance. Whether you're a business in need of exceptional talent or a professional seeking a career leap, the choice of recruiter can make a significant difference.

For businesses, it's important to look for recruiters or headhunters who demonstrate a thorough understanding of the insurance sector, including its trends and challenges. They should also have a proven track record of placements in the specific area of insurance that aligns with your company's needs.

For individuals, choosing a firm that offers personalized guidance and has a strong network in your area of expertise is crucial. A good recruiter should not only assist in finding opportunities but also provide insights into market trends and career development advice tailored to the insurance industry.

In this article, we’ll take a look at 10 of the best insurance recruiters and executive search firms out there, helping you narrow down your search and get closer to connecting with the perfect choice.

TL;DR Top 6 Insurance Recruiters, Headhunters, and Executive Search Firms

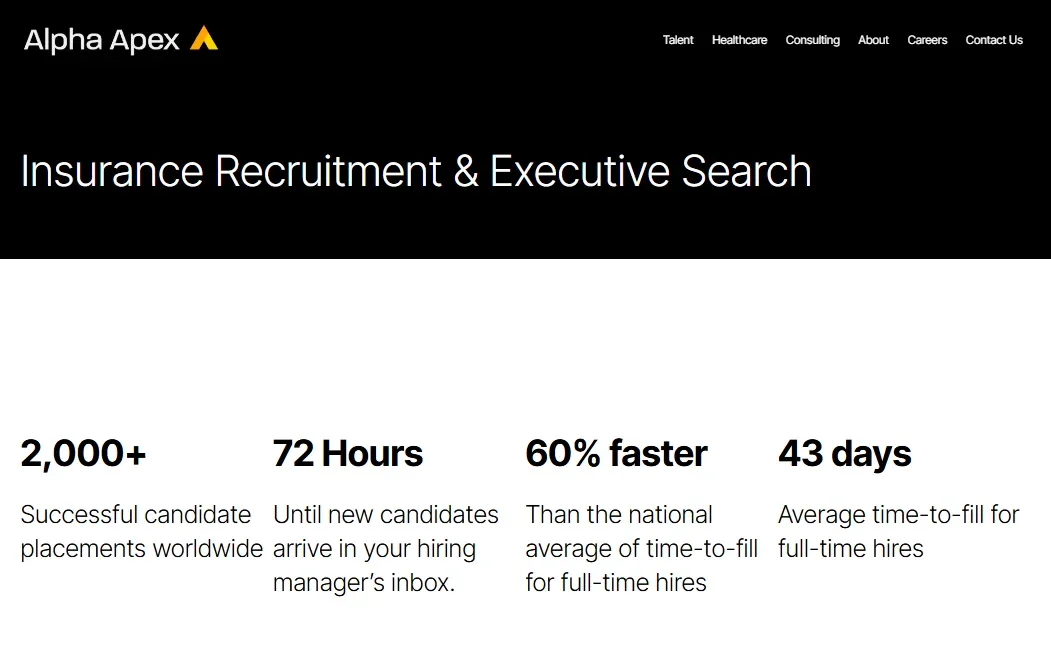

Alpha Apex Group: Alpha Apex Group is a leading executive search firm for the insurance sector, specializing in matching insurance companies with visionary leaders skilled in navigating regulatory challenges, driving digital transformation, and leading strategic growth, ensuring resilience and customer-focused innovation in a dynamic industry.

The Jacobson Group: A leading insurance executive search firm with 50 years of experience, specializing in C-level and senior technical positions, known for its client-centric approach and commitment to diversity, equity, and inclusion.

Caldwell: A premier global executive search firm with over 50 years of expertise, especially in the insurance sector, offering discreet and tailored human talent solutions worldwide.

Stanton Chase: A global leader in executive search established in 1990, specializing in the insurance industry with deep market understanding and an extensive network, focusing on C-level and senior roles.

Cowen Partners: A national insurance executive search firm renowned for its expertise in Commercial and Property & Casualty sectors, known for delivering top-tier insurance executives and achieving high client satisfaction.

Eliot Partnership: The only global insurance sector specialist executive search firm, offering bespoke solutions for talent identification and advisory services, with a focus on strategic hiring and DEI strategies.

Alpha Apex Group, Leaders in Insurance Recruitment.

Alpha Apex Group is a premier executive search firm in the insurance sector, renowned for its expertise in connecting insurance companies with exceptional leadership talent. Leveraging deep industry insights into the insurance market's complexities, they excel at identifying and attracting professionals who can navigate regulatory environments, drive innovation in product and service offerings, and lead strategic growth initiatives.

Their targeted approach focuses on sourcing candidates who combine in-depth knowledge of insurance products, risk management, and digital transformation capabilities with the leadership skills necessary to steer companies through the evolving landscape of the insurance industry. Alpha Apex Group's commitment to excellence and a meticulous candidate evaluation process ensure the delivery of professionals capable of leading the insurance sector toward resilience, innovation, and customer-centric growth.

Key services:

Insurance Executive Search: Customized recruitment strategies to identify and secure leadership talent across a range of executive roles, including CEOs, CFOs, and Chief Risk Officers.

Leadership Assessment and Development: Comprehensive evaluation of candidates to ensure alignment with the strategic needs and culture of insurance firms, coupled with leadership development support.

Innovation and Digital Transformation: Sourcing leaders proficient in driving digital initiatives that enhance customer engagement and streamline operations.

Regulatory Compliance and Risk Management: Recruitment of professionals with expertise in navigating the regulatory landscape and implementing effective risk management strategies.

Market Expansion and Strategic Planning: Identifying executives capable of guiding insurance companies through market expansion, product development, and strategic planning to achieve long-term success.

Why work with Alpha Apex Group:

Choosing Alpha Apex Group for your insurance executive search needs means partnering with a firm that not only understands the insurance industry's unique challenges but also the critical role of visionary leadership in overcoming them. Their expertise in sourcing candidates who are not just skilled in insurance practices but also capable of leading with innovation and strategic insight ensures insurance companies are well-equipped to thrive in a competitive and rapidly changing market.

2. The Jacobson Group

The Jacobson Group is a distinguished insurance executive search firm, excelling in connecting organizations with top-tier insurance talent for 50 years. Focused exclusively on insurance executive recruiting, Jacobson offers specialized services for C-Level, Senior Management, Senior Technical positions, and Board of Directors. They blend art and science in their search and selection approach, exceeding client expectations through a deep understanding of the insurance and reinsurance sectors and related financial services.

Jacobson's client-centric approach fosters long-term partnerships and success by accurately positioning clients' ambitions to attract superior talent.

Jacobson's dedicated team, comprising senior consultants and partner-level executives, ensures each search assignment receives ample resources and innovative strategies. Jacobson actively supports DEI in the insurance industry through various programs and initiatives, promoting a more equitable and inclusive work environment.

Key Services

Executive Search and Selection Consulting

Client-Centric Focus for Long-Term Partnerships

Wealth of Resources with Dedicated Search Teams

Customized Approach with In-House Research

Strong Commitment to Diversity, Equity, and Inclusion

Why Work with The Jacobson Group

The Jacobson Group's expertise in insurance executive search, combined with its comprehensive approach and dedication to diversity, makes it a leader in connecting organizations with exceptional talent, ensuring long-term success and satisfaction.

3. Caldwell

Caldwell is a premier global executive search firm with a specialized focus in the insurance sector. For over 50 years, Caldwell has offered top-quality, discreet, and timely executive search and human talent solutions worldwide. They stand out for their deep industry experience, particularly in insurance, where they have successfully placed executives in diverse roles across CEO, underwriting, risk management, operations, sales/marketing, legal/compliance, and Board of Directors positions.

Caldwell's approach integrates market-leading expertise, in-depth sector knowledge, comprehensive market research, and a long-term relationship orientation to meet clients' specific needs.

Key Services

Executive Leadership Searches Globally

Specialized and Dedicated Teams

In-Depth Industry Experience and Market Research

Long-Term Client Relationship Focus

CEO Succession and Board Renewal Services

Why Work with Caldwell

Caldwell's commitment to delivering tailored executive search solutions, backed by their extensive global network, deep sector expertise, and a unique approach to each search, makes them a top choice for organizations seeking transformative leadership talent in the insurance industry and beyond.

4. Stanton Chase

Stanton Chase, established in 1990 by a group of entrepreneurial executive search firm owners, is a global leader in executive search, especially in the insurance industry. With its global practice centered in London, the world's largest insurance and investment market, Stanton Chase stands out for its deep understanding of the market and extensive network of experts.

The firm specializes in filling key C-level positions and other senior roles across various segments of the insurance industry, including life and pensions, property and casualty, and reinsurance. Their services go beyond traditional executive search, emphasizing long-term partnerships, a culture of friendship and trust, and deep integration with clients' businesses.

Key Services:

Executive Search and Recruitment in the Insurance Sector

Deep Industry Experience and Global Network

Partner-Led, Consistent Team Throughout Search Process

Executive Assessment, Board Services, Succession Planning

Why Work with Stanton Chase

Stanton Chase's approach is marked by personalized and detailed attention to each assignment, a commitment to diversity, equity, and inclusion, and a wide global reach with experienced consultants in 45 countries. Their offices are partner-owned, promoting a shared sense of responsibility and dedication to client success. This unique structure, coupled with their extensive industry expertise and a proven track record in the insurance sector, makes them a reliable choice for companies seeking transformative leadership talent.

5. Cowen Partners

Cowen Partners is a distinguished national insurance executive search firm renowned for its expertise in recruiting top-tier insurance executives across both Commercial and Property & Casualty (P&C) sectors.

Celebrated for their work in leading publications like the Insurance Journal, Forbes, and Bloomberg, they specialize in finding and placing world-class talent in various insurance roles, serving a broad range of sectors from carriers and brokers to Insurtech and reinsurance providers. Their recruiters, skilled in vetting and sourcing, cover the entire corporate hierarchy, ensuring they meet the unique needs and exceed the expectations of each client.

Key Services

Comprehensive Insurance Executive Search

Vetting, Sourcing, and Screening of Talent

Placing Talent Across Entire Corporate Hierarchy

Specialization in Various Insurance Roles and Sectors

Why work with Cowen Partners

Cowen Partners stands out for its proven process that delivers three times more qualified candidates than the competition, consistently finding and placing the top 1% of candidates. Their expertise spans various industries, and they are known for creating significant value for their clients, making them a leading choice in insurance executive recruitment.

6. Eliot Partnership

Eliot Partnership is the only global insurance sector specialist executive search firm in the world, boasting a unique boutique yet global presence. Established with a vision to prioritize client needs, the firm is dedicated to delivering in-depth market knowledge, enabling clients to recruit exceptional leaders and build high-performing teams.

Eliot Partnership is renowned for its strategic hiring focus, covering roles from the C-suite to senior management across insurance and reinsurance sectors, including market-facing and infrastructure roles.

Key Services

Bespoke solutions for talent identification, assessment, and optimization

Tailored advisory services for innovative talent management strategies

In-depth research and strategic hiring for various senior roles

Guidance on disruptive technology, digitalization, and DEI talent strategies

Why work with Eliot Partnership

Eliot Partnership stands out for its commitment to excellence, delivering high-quality, tailored services that ensure client success. Their approach is built on collaboration and inclusivity, attracting a diverse team and promoting unique contributions. This philosophy, coupled with their in-depth industry knowledge and global yet local approach, positions them as a leader in global insurance executive search.

7. Odgers Berndtson

Odgers Berndtson is a prominent executive search firm that works with a variety of industries but extends its expertise to insurance recruitment.

Their focus is identifying outstanding leadership teams, so they provide organizations with the needed tools to secure top-tier leadership appointments.

In fact, they boast a dynamic selection of potential candidates for executive roles.

However, their unique value point is blending industry and functional expertise with cultural and geographic knowledge. And you’ll need that if you’re hiring for niche, regional roles.

Industries: Insurance, Business & Professional Services, Consumer, Entertainment & Sport, Education, Financial Services, Industrial, Public & Not For Profit, Sustainability, Technology & IT Services, Healthcare & Life Sciences

Key services:

Executive Search

Interim Management

Senior Management Recruitment

Leadership Advisory

Inclusion & Diversity Consulting

Reason to work with Odgers Berndtson: Work with Odgers Berndtson for their blend of industry and functional expertise. This gets you access to a dynamic selection of candidates for your insurance leadership roles.

8. Stone Executive

Stone Executive is a prominent executive search and headhunting firm with a strong track record in the insurance sector. Their Insurance Executive Search practice is bolstered by financial services headhunting experts, specializing in senior appointments including chair, chief executive, non-executive, and director-level roles.

They also excel in recruiting high-caliber professionals for senior and middle management positions in general insurance, health and protection insurance, and life insurance. The firm addresses the challenges of the insurance industry by identifying leaders capable of innovating in business models, customer engagement, proposition development, policy administration, and claims management.

Key Services

Insurance Executive Search and Headhunting

Recruitment for Senior and Middle Management Roles

Why work with Stone Executive

Stone Executive is distinguished by its extensive professional network and deep understanding of the insurance industry. Their expertise in engaging with top-tier professionals ensures that clients can recruit leaders with the vision and drive needed for both short-term impact and long-term value. The firm's tailored approach and commitment to delivering high-quality recruitment solutions make it a preferred choice for various companies across the UK.

9. IRES, Inc. Recruiters

IRES, Inc. Recruiters is a specialized recruitment firm dedicated to the insurance industry since 1991. They have built a reputation for placing almost four hundred Surety Bond Professionals across the USA and providing actuarial recruitment for CAS and SOA accreditation. IRES also focuses on Property and Casualty Recruiting for a range of roles, including underwriting and marketing management, and specializes in areas such as Workers' Compensation, Professional Liability, and Program Management.

Key Services

Retained Insurance Recruiting Services

Hybrid Insurance Recruiter Services

Tailored recruitment process covering candidate identification, behavioral evaluation, and post-hire consultation

Why work with IRES, Inc. Recruiters

IRES, Inc. sets itself apart with a commitment to refining the art and science of recruiting, focusing on a thorough and time-tested process rather than rapid resume distribution. They emphasize the importance of properly assessing and vetting candidates, resulting in many professionals remaining with their original employer for fifteen years or more since being hired. Their approach is designed to protect their clients' images and provide world-class service.

10. Slayton Search Partners

Slayton Search Partners is a distinguished executive search firm specializing in the insurance sector. The insurance industry faces unique challenges such as talent shortages and strict government regulations, prompting a need for innovative leadership strategies.

Slayton Search Partners addresses these challenges by recruiting a diverse array of industry leaders for some of the largest and most respected insurance companies worldwide. Their focus is on balancing deep insurance expertise with fresh perspectives from outside the industry to foster innovation in a talent-starved sector.

Key Services

Executive recruitment for large and respected insurance companies

Talent acquisition balancing insurance expertise and external perspectives

Addressing industry challenges such as talent shortages and stringent regulations

Why work with Slayton Search Partners

Slayton Search Partners stands out for their ability to navigate the evolving landscape of the insurance industry, expertly balancing the need for deep sector knowledge with innovative perspectives to recruit transformative leadership talents.

11. Intrinsic Executive Search

Intrinsic Executive Search specializes in recruiting top-tier talent for InsurTech SaaS businesses. They are renowned for supporting InsurTech SaaS firms in the UK, EMEA, and North America to develop elite teams by identifying, attracting, and recruiting critical SaaS talent.

Intrinsic plays a vital role in the digital transformation of the insurance industry, which is expected to reach $193.24 billion by 2025. They have a robust network of senior commercial professionals and revenue generators in the European Insurance vertical. Intrinsic is committed to supporting InsurTech firms with their most critical hiring needs, ensuring they partner with firms that deeply understand and are passionate about the space.

Key Services

Executive search for InsurTech SaaS companies

Recruitment of senior-level commercial positions

Support in digital transformation and innovation in insurance

Why work with Intrinsic Executive Search

Intrinsic Executive Search is pivotal for businesses aiming to navigate the rapidly evolving InsurTech landscape. Their expertise in recruiting high-caliber executives, coupled with their deep understanding of digital transformation in insurance, makes them an invaluable partner for firms looking to excel in this dynamic sector.

12. Newman Group

The Newman Group stands out as a distinguished executive search firm specializing in the insurance industry for over 30 years. Their expertise lies in building innovative business and leadership teams for insurance companies across the nation, making them a leader in this niche.

They possess a rich history in recruiting for commercial insurance and employee benefits sectors, demonstrating their deep understanding and commitment to this industry. As part of the Sanford Rose Associates® network, Newman Group offers their clients global access to vast resources, ensuring a streamlined and effective search process for top talent in the insurance sector.

Key Services

Executive recruitment

Talent acquisition

Career advancement for top talents

Team building for clients

Why Work with Newman Group

Their extensive experience and global network, as part of Sanford Rose Associates®, provide clients with exceptional resources and expertise in finding the best talent in the insurance industry, simplifying the recruitment process and ensuring the right fit for each role.

13. Keller Executive Search

Keller Executive Search is a prominent executive search and recruitment firm in the insurance industry, addressing the challenging task of recruiting top-tier professionals in a market facing a global shortage of seasoned leaders. Their focus on adapting to market dynamics, such as the expansion of middle classes in emerging markets and the impact of disruptive technologies in traditional markets, positions them as a forward-thinking partner for insurance companies.

Keller's recruiters tap into their industry knowledge and extensive network to fill a wide range of roles, from CEOs to customer service representatives, across various insurance fields including property, health, and commercial insurance. They tailor their services to each client's unique culture and specific goals, ensuring a perfect match between companies and candidates.

Key Services

Executive search for high-level positions like CEO, CFO, COO

Recruitment for various insurance roles such as sales managers, claims managers, underwriters, and actuaries

Why Work with Keller Executive Search

Their comprehensive understanding of the insurance industry, combined with a client-focused and cooperative recruiting approach, allows them to forge lasting relationships with clients and consistently deliver high-quality talent solutions.

14. Capstone Search Group

Capstone Search Group is a distinctive player in the real estate recruitment field, known for its innovative approach.

Here’s what makes them unique:

Their method focuses on project development and candidate engagement. And that means they deliver results with speed and precision.

With a specialized understanding of the real estate industry, they cater to the unique hiring challenges within the sector.

And they’ve developed Capstone’s Resource Library.

This collection of talent management tools further enhances their ability to meet client needs at every step of the process, whether you’re hiring for contract positions or permanent roles.

Industries: Insurance

Key services:

Direct Hire

Executive Search

Alternative Staffing

Capstone Consulting

Reason to Work with Capstone Search Group: Work with Capstone for their unique approach, focusing on project development and candidate engagement. This approach leads to faster and more tailored results.

15. The Rogan GrouP

The Rogan Group is a distinguished executive search firm specializing in the insurance industry.

They offer nationwide coverage with headquarters in Maryland and a network of remote recruiters across the country.

Their unique value point is their experience.

The Rogan Group has a strong track record in risk and insurance management recruiting since 1991.

This extensive experience makes them a trusted resource for insurance-related talent acquisition.

And they use it to serve various areas within the insurance sector, including agents, brokers, program administrators, risk management consultants, and TPAs.

Industries: Insurance

Key services:

Executive Search

M&A Search & Solicitation

Temporary Services

Reason to work with The Rogan Group: Consider The Rogan Group for their specialized focus on the distribution sector of the insurance industry as well as their extensive expertise..

16. The James Allen & Companies, Inc.

The James Allen & Companies, Inc. is a staffing and recruiting firm catering to insurance carriers of all sizes, wholesale brokerages, retail agencies, Managing General Agents, Managing General Underwriters, and Third Party Administrators.

They offer a wide range of search services, including contingency, contained, and retained.

But, they’re best known for their advanced search technology and qualification strategies.

With over fifteen years of experience, their expertise lies in connecting with and delivering senior-level insurance professionals.

And they leverage their in-depth industry knowledge to identify qualified candidates who best serve clients’ needs and parameters.

Industries: Insurance

Key services:

Executive Search

Key Hire Search

Temporary Staffing

Temp To Full-Time

Reason to work with The James Allen & Companies, Inc.: Choose them for their advanced search technology and qualification strategies, which result in ideal candidate placements.

17. AllSearch Recruiting

AllSearch Recruiting is a well-established firm with a 20-year internal database of talented insurance professionals.

They specialize in recruiting for a wide range of roles within the insurance industry, including commercial and personal P&C, agency, carriers, and specialty insurers.

Plus, they’re very knowledgeable in what they do.

That’s because they’re led by experienced industry professionals with a deep understanding of the insurance world, roles, and companies.

In fact, this unique combination of hands-on insurance experience and recruiting expertise sets them apart in the field.

And you can leverage this expertise regardless of your company’s size.

They cater to a diverse client base, from small independent agencies to large corporate firms, offering a comprehensive and knowledgeable approach to insurance talent acquisition.

Industries: Insurance, Manufacturing, Construction & Mechanical Services, Wholesale & Distribution, Facilities Management

Key services:

Executive Search & Recruiting

Human Resources

Talent Management

Reason to work with AllSearch Recruiting: Consider AllSearch for its rich internal database and network of insurance professionals for various insurance roles.

18. MGA Insurance Recruiters

MGA Insurance Recruiters is a specialized search and placement executive search consultant focused on the insurance industry.

They bring a wealth of practical company experience, with consultants boasting an average of 20 or more years in both staff and line management positions.

MGA’s unique value point is its disciplined search process.

Their success is built on meticulously analyzing client needs and candidate aspirations.

Here’s the downside:

MGA primarily operates within the greater New Jersey and New York metropolitan areas.

They sometimes undertake specialized searches across the U.S. through their association with the National Insurance Recruiters Association (NIRA).

Pro tip: Membership in NIRA is by invitation only, underscoring their reputation as a trusted player in the insurance recruitment arena.

Industries: Insurance

Key services:

Executive Search & Recruiting

Temporary Services

Staffing

Reason to work with MGA Insurance Recruiters: Choose MGA for their disciplined search procedure and in-depth understanding of the New Jersey and New York metropolitan area’s insurance market.

19. LaMorte Search Associates

LaMorte Search Associates is a reputable recruiting firm with a strong presence in the insurance industry since 1986.

They excel in national recruitment, so you can strategically hire the country’s most talented and high-achieving candidates.

Here’s how they do it:

LaMorte Search Associates casts a wide net in the candidate search process, encompassing both active and passive candidates. That means you’ll have access to the entire talent marketplace.

Plus, their unique approach is building solid business relationships with clients.

This is evident in their proactive approach.

LaMorte takes the time to thoroughly understand each client’s employees, culture, and business preferences. That’s how they hire the right people for all teams, minimizing costs.

Industries: Insurance

Key services:

Executive Search & Recruiting

Human Resource Strategy

Consulting

Reason to work with LaMorte Search Associates: Partner with LaMorte for their emphasis on building solid business relationships. Their proactive steps to understand your company’s unique needs are also a neat advantage.

20. McDermott Wolfe

McDermott Wolfe is a specialized insurance recruiting firm that brings unique insight to the insurance brokerage industry.

They focus on commercial insurance, personal lines, and employee benefits brokerage professionals.

Here’s why you should consider them:

They were established in 2010 by industry professionals with two decades of experience, so they genuinely understand the day-to-day roles within the field.

Plus, their recruitment approach is based on building meaningful relationships with both clients and candidates.

That’s how McDermott Wolfe has successfully placed over 2,000 industry experts – a strong point in their favor.

Industries: Insurance

Key services:

Executive Search & Recruiting

Direct Hire

Temporary Staffing

Reason to work with McDermottWolfe: Opt for McDermottWolfe for their unique insight into the insurance brokerage industry and their passion for building meaningful relationships with clients and candidates.

21. DGA

DGA is an executive search and recruitment firm exclusively focused on the insurance industry.

DGA has operated across Canada and the United States since 1986, so they have a deep industry experience.

Side note: As members of the National Insurance Recruiters Association (NIRA), they have access to an extensive network of US candidates through affiliates across the United States.

And they’ve also built strong relationships.

This combination enables them to connect leading insurers, insurance brokerage firms, and independent adjusting firms with talented candidates for each insurance job.

Plus, DGA hires consultants with extensive industry backgrounds, including former insurance executives.

That means the agency possesses unmatched access to senior executives and firms in the insurance sector.

Industries: Insurance

Key services:

Executive Search

Insurance Industry Recruitment

Assessment

Reason to work with DGA: Choose DGA for their exclusive focus on the insurance industry, extensive experience, and unparalleled access to top industry talent.

22. Boyden

Boyden is a premier global leadership and talent advisory firm, established in 1946, with more than 75 offices in over 45 countries. The firm specializes in executive search, interim management, and leadership consulting, assisting organizations across various industries in identifying and developing senior leadership talent.

Here's why you should consider them:

Boyden stands out due to its highly personalized and consultative approach to executive search and leadership advisory. Their global reach combined with local market expertise ensures that clients receive solutions tailored to their specific needs, whether they are a multinational corporation or a rapidly growing fintech startup. With a strong focus on innovation, digital transformation, and risk management, Boyden provides organizations with the leadership necessary to thrive in an evolving financial landscape.

Industries: Financial Services, Technology, Healthcare & Life Sciences, Industrial, Consumer & Retail

Key Services:

Executive Search

Interim Management

Leadership Consulting

Digital Transformation Consulting

Risk Management Advisory

Reason to work with Boyden: With a legacy spanning over seven decades, Boyden combines deep industry knowledge with a global network of consultants to deliver tailored leadership solutions. Their commitment to understanding the evolving dynamics of the financial sector ensures that clients receive strategic insights and access to exceptional talent, enabling them to navigate complex challenges and achieve sustainable success.

Key Factors to Consider When Choosing an Insurance Recruiter, Headhunter, or Executive Search Firm

Finding the right insurance recruiter can be tough. Here’s a list of key factors to keep in mind during your search.

Expertise in the Insurance Industry: Look for firms with a proven track record in the insurance sector, demonstrating an understanding of its unique challenges and opportunities

Network and Reach: Evaluate their network's breadth and depth in the insurance industry to ensure they can access the best talent

Reputation and Reviews: Research their reputation within the industry. Client and candidate testimonials can provide valuable insights

Customization of Services: Consider whether they offer tailored services to meet your specific hiring needs and company culture

Success Rate and Metrics: Inquire about their success rates, including the longevity of placements and the satisfaction of clients

Transparency and Communication: Choose a firm that maintains clear, consistent communication throughout the recruitment process

Ethical Practices and Confidentiality: Ensure they adhere to ethical recruitment practices and maintain confidentiality, which is crucial in executive searches

What Insurance Recruiter, Headhunter, or Executive Search Firm Will You Choose?

Choosing the right recruiter or executive search firm in the insurance industry is crucial for finding top talent that not only meets the job requirements but also fits seamlessly into your company culture. With so many factors to consider, from their industry expertise to their ethical standards, the decision can be complex.

However, by taking the time to evaluate each firm against these key considerations, you can make an informed choice that will benefit your organization in the long term. Your ideal partner in recruitment is out there, ready to help you navigate the dynamic and challenging world of insurance talent acquisition.