Why Hire a Fractional CFO? Key Benefits & How It Can Drive Business Growth

As a small business owner, you're stretched thin managing various aspects of your growing company, including finances. You need strategic financial guidance but can't afford a full-time CFO.

The solution? Hiring a fractional CFO.

This approach can lead to significant cost savings—businesses can achieve up to 40% savings by utilizing fractional resources compared to employing full-time staff.

This article will explore ten reasons why bringing on a fractional CFO can provide the expert financial leadership you need without the full-time commitment and cost.

Discover how this flexible approach can help you navigate growth and unlock your business's full potential.

Let’s dive in.

The Rise of Fractional CFOs in the Evolving Business Environment

The fractional Chief Financial Officer (CFO) role has gained prominence, especially post-pandemic, as it addresses the financial leadership needs of today's dynamic business environment.

These part-time financial experts provide strategic guidance to companies, especially startups and small to medium-sized businesses, which may not have the resources to hire a full-time CFO.

From 2019 to 2020, there was a noticeable 27% increase in CFO resignations, leading to a surge in interest for fractional or part-time CFOs who can adapt quickly to what early-stage startups need.

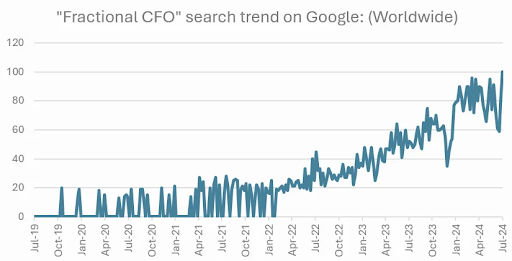

The chart below from Google Trends illustrates the global search volume for the term "Fractional CFO" on Google over the past five years. Starting from virtually no searches in 2019, the data shows a clear and significant upward trend in the past two years, reflecting the growing interest in the term.

The rise of fractional CFOs is a response to the shifting needs in the financial sector, where companies, particularly agile ones poised for rapid growth, recognize the value of such roles.

This trend was underscored by a record year in venture capital funding, signifying a heightened need for financial expertise in navigating investment markets.

The reason is that the fractional CFO model offers businesses financial leadership at a fraction of the cost of a full-time executive, coupled with the flexibility to scale services according to business needs.

But you may need a fractional CFO for different reasons.

Let’s explore these below.

10 Reasons to Hire a Fractional CFO

Let’s see the best reasons why you should consider a fractional CFO, with examples and lessons to remember.

Reason #1. Cost-Effective Expertise

The cost-effectiveness of hiring a fractional CFO compared to a full-time CFO is particularly compelling for small to mid-sized businesses. But even if you have a larger company, you may still find this reason persuasive.

After all, a fractional CFO provides high-level financial expertise without the full-time salary and benefits package, which can be a significant saving. Full-time CFOs command high salaries, with the national average salary ranging from around $203,750 to $420,000 annually, depending on the company size and geographical location. This figure doesn't include additional costs such as benefits, bonuses, and stock options, which can significantly increase the total compensation package.

Now, let’s look at the reverse of the medal.

Fractional CFOs typically charge hourly rates or offer services through monthly retainers, providing a more flexible and budget-friendly solution.

Hourly rates for fractional CFOs are generally between $250 and $500, with monthly retainer fees usually falling between $5,000 and $12,000, depending on the hours and complexity of work required.

This arrangement allows businesses to access experienced financial guidance while managing costs more effectively.

Lesson learned: Engaging a fractional CFO can be an astute choice if you need strategic financial insight but must be mindful of budget constraints.

Reason #2. Enhanced Decision-Making

Fractional CFOs are critical in enhancing decision-making within startups and growth-stage companies by providing relevant and accurate financial information. These finance professionals manage financial tasks, optimize cash flow, and guide strategic planning and reporting.

By comparison, a traditional bookkeeper/ accounting firm mainly does bookkeeping (as the name suggests) plus tax preparation.

Hence, the main benefit:

Their involvement lets you focus on core operations while navigating financial challenges with expertise.

Case Study Break: How to Leverage a CFO’s Decision-Making Abilities

For example, Burkland Associates has demonstrated the impact of fractional CFOs through their engagement with Segment. This company scaled effectively under their guidance and was eventually acquired by Twilio for $3.2 billion. This example showcases how fractional CFOs offer cost-effective strategic finance support and contribute significantly to the scaling and success of startups.f

Moreover, companies like Velo CFO offer tailored financial and strategic advisory services, proving invaluable for venture-backed startups and investment firms. Their services facilitate in-depth financial assessments and strategic guidance, which empowers clients to make informed investment and business decisions.

Again, this example illustrates the profound effect of expert fractional CFO leadership on a company's success.

Lesson learned: Choose a fractional CFO to minimize financial risks and enhance your firm’s decision-making processes. As such, you can skyrocket your growth and strategic financial management.

Reason #3. Objective Advice

Fractional CFOs deliver objective advice, which is crucial for unbiased financial decision-making. Their external position ensures recommendations are based solely on data and strategic needs, not swayed by internal politics or relationships.

This detachment allows them to focus on what’s financially best for the company, leading to more effective and strategic decision-making.

As part-time advisors, they maintain a broad perspective, drawing from diverse industry experiences. And that only enriches the advice given to clients like you.

This external viewpoint aids in identifying areas for financial improvement and risk management that your internal stakeholders might overlook due to familiarity or internal bias.

Besides, a study involving 4,000 small and medium-sized businesses revealed that utilizing external financial advisors, such as fractional CFOs, led to an average revenue increase of 11.5%.

Lesson learned: Choose a fractional CFO if you need impartial analysis to navigate financial complexities with clear, actionable insights. This will foster a decision-making environment in your company that is both strategic and data-driven.

Reason #4: Quick Access to Specialized Skills and Talent

Businesses seeking rapid, strategic financial guidance can greatly benefit from onboarding a fractional CFO, bypassing the prolonged and cumbersome process of hiring a full-time executive.

This approach provides immediate access to experienced financial professionals with specific skill sets tailored to their unique needs.

So, instead of navigating through a lengthy recruitment process, you can engage a fractional CFO on a contract basis, significantly reducing the time to onboard and integrate this critical strategic role into their operations.

This flexibility means you can swiftly address specific financial challenges or opportunities without the commitment and overhead associated with a permanent role. Moreover, fractional CFOs bring a wealth of experience from various sectors and companies, providing a broad perspective and specialized expertise on demand.

For instance, Consultport matches clients with suitable fractional managers or experts within 48 hours, enabling swift responses to resource gaps. Alpha Apex Group is another fast, but high-quality consulting & executive search firm. This expedited access to solid professionals allows you to promptly address all your specific financial challenges or opportunities. That’s because you’ll leverage the diverse experience fractional CFOs bring from various sectors.

Lesson learned: Choose a fractional CFO if you need to make quick strategic decisions regarding financial management.

Reason #5: Flexibility and Scalability

The flexibility and scalability offered by a fractional CFO are significant, especially as an organization grows and its financial needs evolve.

Basically, you can adjust the CFO's hours and responsibilities based on your company's current requirements and budget constraints.

Case Study: FixturFab's Transition with a Fractional CFO

During rapid growth or fundraising periods, you can increase the fractional CFO’s involvement to navigate these critical phases. Conversely, the engagement can be scaled back during more stable periods to manage costs.

FixturFab, a startup founded by engineers Joe Selvik and Duncan Lowder, initially focused on selling a software tool. As they recognized a greater opportunity in manufacturing, they transitioned into a high-tech manufacturing business.

This shift introduced complexities in procurement, inventory management, and cost accounting.

By engaging a fractional CFO, FixturFab received tailored financial guidance that evolved with their changing business model, enabling them to manage growth effectively without the commitment of a full-time CFO.

“Before the ERP, we were never able to answer basic questions like, ‘What are your assets now? What is your inventory valuation?’ All the basics that we should be thinking about.” (Joe Selvik, FixturFab founder)

This adaptable approach ensures that you pay only for the level of service you need, optimizing your financial management and supporting sustainable growth.

Lesson learned: Choose a fractional CFO if you need financial efficiency and access to senior financial expertise whenever you need it the most.

Reason #6: Focus on Core Competencies

Outsourcing the CFO function to a fractional executive enables your company leadership to concentrate on its core competencies, thus driving business growth.

Basically, your CEOs and other key leaders can focus their time and resources on areas where they have the most impact, such as product development, market expansion, and customer engagement, rather than getting bogged down in complex financial management tasks.

That’s why a 2024 report revealed that 90% of CFOs are outsourcing at least some accounting functions to address staffing challenges and focus on strategic initiatives.

Example Time: How a CFO Can Help Tech Startups

We’ve seen it time and again.

Tech startups are typically led by founders with strong product development but limited financial expertise. That’s why they benefit significantly from this model.

By engaging a fractional CFO, these companies can ensure financial strategy and operations are handled expertly while the founders focus on innovation and growth. This separation of financial management from daily operations leads to more effective use of the leadership’s time and skills, directly contributing to the company's growth and success.

Lesson learned: Hire a fractional CFO to maximize the existing team's strengths and inject senior financial expertise into the organization efficiently. That way, you can ensure strategic financial decisions that support your company’s core mission and growth objectives.

Reason #7: Improved Financial Controls and Internal Processes

Fractional CFOs enhance your financial controls and internal processes, leading to more efficient operations and compliance. That’s because they bring an objective perspective to evaluate your existing financial systems, identifying areas for improvement and implementing best practices tailored to your business needs.

Insider tip: By strengthening financial controls, fractional CFOs help prevent fraud, reduce waste, and ensure accuracy in financial reporting. In 2022, nearly 70% of financial institutions reported losses of at least $500,000 due to fraud, underscoring the importance of effective financial oversight.

Example Break: How a CFO Can Help SMEs Financial Controls

Small to medium-sized enterprises (SMEs) often lack the resources to maintain robust financial systems. A fractional CFO can step in to develop and oversee financial controls, budgeting processes, and compliance protocols.

As such, the company can adhere to regulatory requirements while optimizing financial performance.

Moreover, in rapidly growing companies, financial transactions become more complex. Here, fractional CFOs can streamline processes, introduce scalable financial systems, and ensure a solid financial structure that supports the organization's growth.

Lesson learned: Hire a fractional CFO if you need strategic input to secure your financial health and support your business strategy.

Example Break: How a CFO Can Help SMEs Financial Controls

Small to medium-sized enterprises (SMEs) often lack the resources to maintain robust financial systems. A fractional CFO can step in to develop and oversee financial controls, budgeting processes, and compliance protocols.

As such, the company can adhere to regulatory requirements while optimizing financial performance.

Moreover, in rapidly growing companies, financial transactions become more complex. Here, fractional CFOs can streamline processes, introduce scalable financial systems, and ensure a solid financial structure that supports the organization's growth.

Lesson learned: Hire a fractional CFO if you needstrategic input to secure your financial health and support your business strategy.

Reason #8: Greater Transparency and Insight

Fractional CFOs implement advanced financial reporting systems, develop comprehensive dashboards, and conduct thorough financial analyses. Therefore, they enhance financial transparency and insight, allowing stakeholders to understand and manage the business more effectively.

A transparent approach ensures that financial data is accurate, timely, and presented in a way that non-financial managers easily understand.

Several financial reporting software tools are recognized for their advanced capabilities:

FreshBooks: Ideal for small businesses, FreshBooks simplifies accounting processes, offering financial reporting solutions such as profit and loss statements, sales tax summaries, general ledgers, trial balances, and charts of accounts. These features facilitate the creation of year-end and quarterly financial presentations.

Xero: Tailored for startups, Xero provides real-time financial data access, enabling businesses to monitor cash flow, automate invoicing, and integrate with various third-party applications for comprehensive financial management.

QuickBooks Online: Known for generating presentation-ready reports, QuickBooks Online offers customizable financial reporting, expense tracking, and seamless integration with banking systems, aiding in efficient financial analysis.

Vena: Leveraging Excel for financial reporting, Vena combines the familiarity of spreadsheets with advanced data consolidation, budgeting, and forecasting capabilities, enhancing financial planning and analysis.

Although specific statistics on the impact of fractional CFOs on financial transparency are scarce, the industry widely acknowledges that companies with robust financial reporting and analysis are better positioned to attract investment and drive growth.

Example Break: How a CFO Can Streamline Processes

For instance, when a company struggles with cash flow visibility, a fractional CFO can establish processes that clarify financial status, revealing the timing and magnitude of cash inflows and outflows. This level of detail empowers business leaders to make informed decisions quickly.

Lesson learned: Hire a fractional CFO to help your stakeholders understand the company's financial health, ensuring they are better equipped to steer it toward its strategic objectives.

Reason #9: Strategic Growth and Expansion Support

Fractional CFOs can guide companies through strategic growth initiatives, such as mergers and acquisitions (M&A), fundraising, and crafting budgets that promote sustainable growth. They leverage their expertise to conduct detailed financial analyses, assess the feasibility of growth strategies, and ensure that financial plans are both ambitious and grounded in financial reality.

Here are specific benefits you can expect.

In the context of M&A, fractional CFOs perform due diligence, evaluating the financial health of potential acquisition targets to ensure they align with the company's strategic goals.

They also prepare financial models to project the future state of the combined entities, helping stakeholders understand the financial implications of the merger or acquisition.

That’s important because, according to recent research, a significant number of mergers and acquisitions fail to meet expectations. Some studies are reporting failure rates as high as 70% to 90%. By leveraging their expertise, Fractional CFOs help mitigate risks and enhance the likelihood of successful transactions.

During fundraising rounds, these CFOs craft compelling financial narratives, prepare investment materials, and engage with potential investors, enhancing the company's ability to secure funding. They analyze financial projections, manage cash flows, and advise on capital structure, ensuring your company is positioned for optimal financial health post-funding.

For budgeting, fractional CFOs implement strategies that balance ambition with prudence. They help set realistic financial targets, identify key performance indicators (KPIs), and establish budgetary controls to allocate resources efficiently. Their insights allow you to confidently navigate financial complexities, ensuring your growth initiatives are backed by solid financial planning and analysis.

Lesson learned: Hire a fractional CFO to gain a strategic advantage during complex financial contexts.

Reason #10: No Long-Term Commitments

This aspect of hiring a fractional CFO offers you significant flexibility, allowing you to adapt to changing financial needs without the constraints of a long-term contract. This flexibility means you can engage CFO services during critical phases, such as financial restructuring, growth spurts, or specific projects, and discontinue or adjust the scope of their services as necessary.

This model provides a cost-effective solution for accessing high-level financial expertise without the long-term financial commitment of a full salary and benefits package.

Moreover, suppose your company's direction changes or the fractional CFO is not the right fit. In that case, you can end the partnership without the complexities and costs of terminating a full-time executive, including severance and potential legal ramifications.

Case Study: Web3 Startup's Strategic Financial Management

A Web3 startup enlisted a fractional CFO with expertise in blockchain accounting and crypto regulations to navigate complex financial landscapes. The fractional CFO implemented systems to track transactions and token distributions, ensuring compliance with evolving regulatory standards.

This strategic involvement allowed the company to scale operations, maintain transparency, and attract significant investment from crypto-focused venture capitalists, leading to a 50% increase in user base within six months post-funding.

Lesson learned: Hire a fractional CFO to maintain agility in a fast-paced business environment and manage your financial leadership needs in line with your evolving strategic and operational goals.

Maximizing Business Potential: The Strategic Advantage of a Fractional CFO

Hiring a fractional CFO brings tons of strategic advantages, from flexible expert financial leadership to a maximized budget, greater transparency, and improved financial controls.

This approach ensures you have high-level financial guidance when it's most crucial, without the long-term costs of a full-time executive.

This approach is flexible and cost-effective, so you can focus on what you do best—growing your business—while leaving the financial complexities to a seasoned professional.

Don't let limited resources hold you back; consider a fractional CFO today.

Frequently Asked Questions (FAQ)

What is a CFO?

A CFO (Chief Financial Officer) oversees a company’s financial strategy, planning, and operations to ensure profitability and long-term growth.

What are the duties of a fractional CFO?

A fractional CFO handles financial planning, cash flow management, budgeting, forecasting, and strategic decision-making, working on a part-time or project basis.

Why should I hire a fractional CFO?

Fractional CFOs offer expert financial guidance without the cost of a full-time hire. This makes them ideal for businesses needing strategic financial leadership.

Can a small business have a CFO?

Yes, a small business can hire a fractional CFO to access high-level financial expertise on a flexible basis.

How much does a fractional CFO charge?

Fractional CFOs typically charge $150 to $350 per hour, depending on their experience and the scope of work. The best fractional CFO agencies can connect you with expert professionals who have more affordable rates.

How many hours does a fractional CFO work?

The hours vary based on the business’s needs, typically ranging from a few hours per week to several hours per month.

Is a fractional CFO the same as an outsourced CFO?

All fractional CFOs are outsourced, but not all outsourced CFOs are fractional. Fractional CFOs work part-time or on specific projects, while outsourced CFOs may provide broader or full-time services.

What is the difference between a fractional CFO and an accountant?

A fractional CFO focuses on strategy, financial planning, and big-picture decisions. An accountant handles day-to-day financial tasks like bookkeeping, tax filing, and compliance.