July 2025: Top 12 CFO Executive Search Firms to Find the Best Financial Leaders

Updated: July 2025

The role of a Chief Financial Officer (CFO) has never been more important than it is today. As guardians of a company's financial well-being, CFOs play a critical role in shaping the economic success of their organizations. The process of identifying and hiring such a vital member of the executive team is a task of great responsibility and requires specialized expertise.

The Value of Specialized CFO Recruiters

Finding the right CFO is more than just matching resumes with job descriptions; it's about understanding the intricate dynamics of finance leadership and corporate culture.

Specialized CFO recruiters, headhunters, and executive search firms are adept at navigating this complex landscape. They bring a deep understanding of the financial industry, access to a vast network of qualified candidates, and the expertise to identify individuals who not only have the required skills but also align with the company's vision and culture.

In this article, we’ll take a closer look at some of the best CFO recruiters and headhunters available today.

TL;DR: Top 6 CFO/Chief Financial Officer Recruiters, Headhunters, & Executive Search Firms

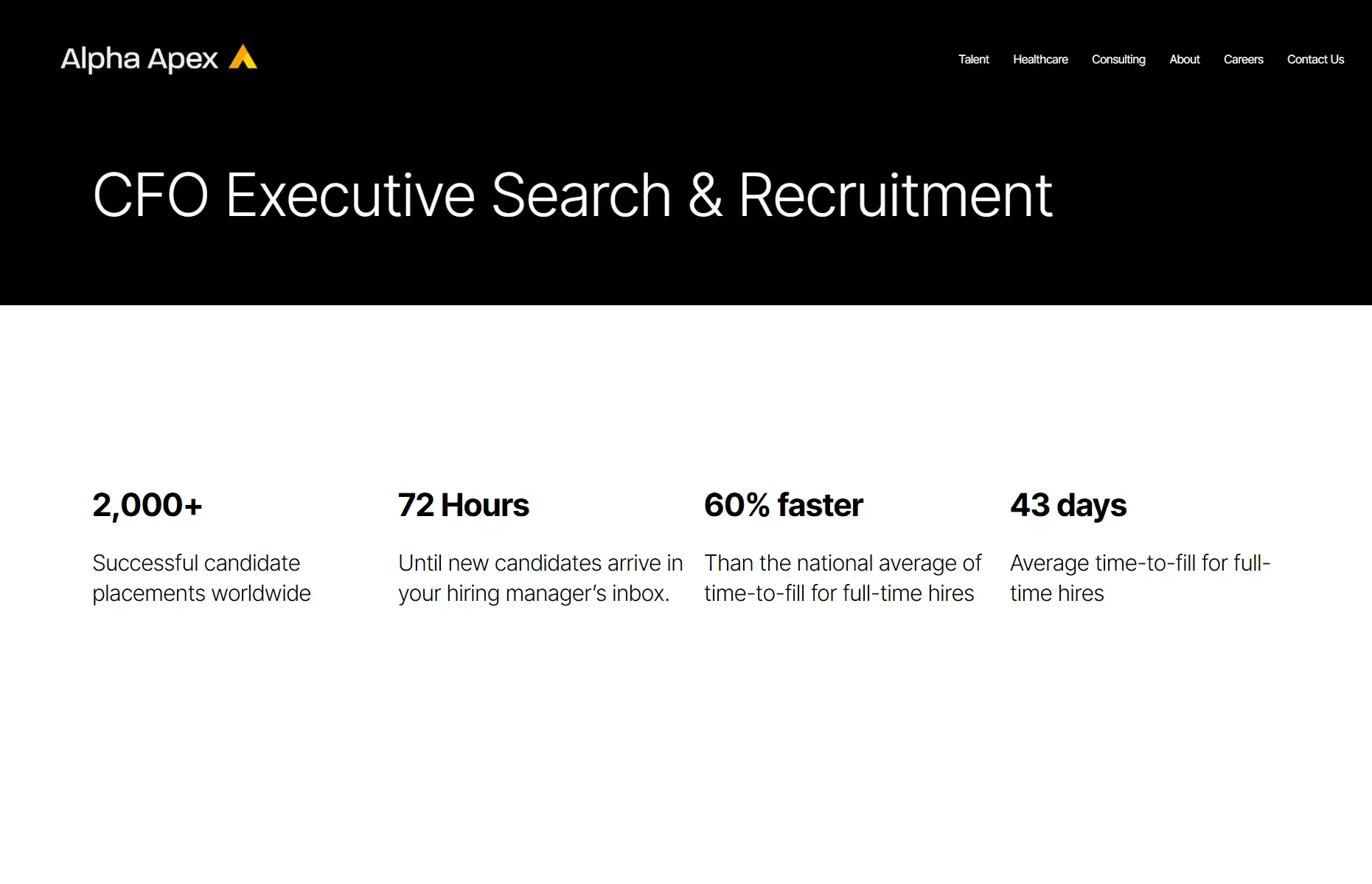

Alpha Apex Group: Alpha Apex Group specializes in executive search for CFOs, blending financial acumen and strategic insight to match companies with leaders capable of guiding financial stability and growth.

Cowen Partners: A leading national executive search firm, Cowen Partners excels in CFO recruitment for a wide range of clients, providing unique services like IPO preparation and CEO succession planning, and is known for sourcing the top 1% of candidates.

Stanton Chase: Stanton Chase specializes in CFO recruitment, offering global executive search and leadership consulting, noted for its strong commitment to diversity, equity, and inclusion, and tailoring its approach to fit each organization's unique culture.

Egon Zehnder: Egon Zehnder is a global leader in executive search, focusing on CFO and Audit Chair recruitment, renowned for understanding the evolving CFO role and prioritizing adaptability and innovation in financial leaders.

JM Search: JM Search, with over 40 years of experience, specializes in recruiting top-tier financial executives, particularly CFOs, for various organizations, emphasizing emotional intelligence and big-picture thinking in candidates.

Osborne Financial Search: A boutique executive search firm founded by Lance Osborne, Osborne Financial Search is dedicated to recruiting CFOs and VP Finance candidates for mid-sized companies, notable for its head-hunting approach and rigorous candidate screening process.

A Deep Dive Into EACH CFO/Chief Financial Officer Recruiter, Headhunter, & Executive Search Firm

Alpha Apex Group, Leaders in Chief Financial Officer Recruitment.

Alpha Apex Group emerges as a leader in the executive search arena, focusing on the recruitment of Chief Financial Officers (CFOs) for companies seeking to navigate financial complexities with confidence. Their expertise in finance and executive search combines to offer unparalleled service in matching organizations with CFOs who bring strategic vision and financial acumen to the table.

Their approach is distinguished by a commitment to understanding each client's unique business challenges and financial objectives. This enables Alpha Apex Group to not only identify but also attract financial leaders who can contribute to sustainable growth and profitability.

Key services:

CFO Executive Search: Precision-driven search services to identify and attract CFOs with the right blend of expertise, leadership, and vision.

Financial Leadership Assessment: Rigorous evaluation processes to ascertain candidates' capabilities in financial management, strategic thinking, and leadership.

Strategic Financial Planning: Assistance in identifying executives capable of steering financial planning and analysis to align with business goals.

Risk Management Talent Search: Recruitment of CFOs with a proven track record in managing financial risk and implementing robust risk management frameworks.

Board Advisory Services: Offering insights and support in financial governance, helping boards understand the strategic value of their financial leadership.

Why work with Alpha Apex Group?

Alpha Apex Group understands that the role of a CFO extends beyond finance to being a strategic partner in the business. Their expertise in sourcing candidates who not only possess exceptional financial management skills but also the ability to drive strategic initiatives makes them an invaluable partner in your executive search. With Alpha Apex Group, companies can rest assured that their CFO recruitment is in expert hands, paving the way for financial stability and strategic growth.

Cowen Partners is a prominent national executive search and consulting firm, specializing in CFO recruitment. They cater to a diverse client base, including small to large organizations, publicly traded companies, pre-IPO firms, private enterprises, and non-profit organizations. Their client portfolio ranges from $50 million to multi-billion dollar companies, including Fortune 100 firms with assets between $500 million to $15 billion.

Key Services:

Executive Search for CFO and Other C-suite Positions

IPO Preparation and SEC Reporting

Corporate Tax and Financial Institution Expertise

Consulting Services in CEO Succession Planning and Interim CFO Solutions

Financial Cashflow, Treasury, Software Implementation, and M&A Services

Why work with Cowen Partners?

Cowen Partners is distinguished for delivering three times more qualified candidates than its competitors. They have a proven retained executive search process that sources and delivers the top 1% of candidates, tailored for diverse industries. Their comprehensive approach, including insider CFO hiring guides and resources, ensures a thorough and effective executive search process.

With a focus on Chief Financial Officer (CFO) recruitment, Stanton Chase offers meticulous executive search and selection processes. Their team consists of over 30 CFO-focused search consultants globally, many with significant backgrounds in finance.

Key Services:

Chief Financial Officer Recruitment

Executive Search and Selection

Leadership Consulting

Succession Planning

Financial Services Leadership Solutions

Diversity, Equity, Inclusion, and Belonging in Recruitment

Why work with Stanton Chase?

Stanton Chase is distinguished for its extensive global network, deep market knowledge, and commitment to diversity, equity, and inclusion in recruitment. Their approach is tailored to match the unique culture and values of each organization, ensuring a perfect fit for financial leadership roles.

Egon Zehnder is a global leader in executive search and consulting, with a specialized focus on CFO and Audit Chair recruitment. Their approach acknowledges the evolving role of financial officers, who must now tackle diverse responsibilities like managing global capital flows, ensuring compliance, and leading transformation initiatives. Egon Zehnder's Financial Officers Practice collaborates closely with boards and chief executives across various ownership structures—publicly and privately held companies, private equity portfolio firms, and family-owned businesses.

Key Services:

CFO Executive Search

Audit Chair Recruitment

Leadership Assessment and Integration

Succession Planning

Building Finance Leadership Teams

Why work with Egon Zehnder?

Egon Zehnder's approach to CFO recruitment is deeply rooted in understanding the evolving nature of the CFO role. They focus on adaptability, innovation, and speed in financial leaders, ensuring these executives are not just technically proficient but also capable of agitating for better performance and generating insights for the C-suite.

JM Search specializes in recruiting top-tier financial executives and CFOs for a diverse range of organizations, including private equity-backed, private, and public companies. With over four decades of experience, JM Search prides itself on its ability to assess candidates not only for their past experience but also for essential qualities like agility, emotional intelligence, and big-picture thinking.

Key Services:

Executive Search for various roles including CFO, CAO, SVP/VP Finance & Accounting, Controller, Head of FP&A, Audit & Tax, Investor Relations

Building diverse, equitable, and inclusive leadership teams

Executive recruitment expertise across various organizational functions and industries

Why work with JM Search?

JM Search’s partners are heavily involved in each search, ensuring a personalized and comprehensive approach. Their commitment to diversity, equity, and inclusion in leadership teams and their expansive network of professional contacts make them a reliable choice.

Osborne Financial Search, founded by Lance Osborne in 2013, is a boutique executive search firm specializing in recruiting Chief Financial Officers (CFOs) and VP Finance candidates for mid-sized companies. With over three decades of experience in finance and accounting executive recruitment, Lance and his team employ a head-hunting approach to proactively identify and approach potential candidates.

Key Services:

Executive Search for CFOs and VP Finance Positions

Thorough Market Research and Head-Hunting

Double Interview Process to Evaluate Candidates' Skills and Fit

Short List Presentation of Qualified Candidates

Rigorous Screening and Candidate Briefing

Managing the Interview Process and Final Hiring Stages

One-Year Replacement Guarantee for Placements

Why work with Osborne Financial Search?

Osborne Financial Search focuses on getting the recruitment right the first time by presenting only rigorously screened candidates that represent the best of the market. Their process is characterized by speed and efficiency, with clients expected to start interviewing candidates within two weeks of initiating the search. The firm's commitment to transparency and working closely with clients to design effective search strategies sets them apart.

7. CFO Search

CFO Search is a leading finance executive search firm specializing in recruiting Chief Financial Officers (CFOs). Established in 2008, the firm has successfully filled over 500 CFO positions nationwide and internationally. CFO Search stands out for its exclusive focus on CFO recruitment, offering both retained and 100% contingency-based services.

Key Services:

CFO recruitment (permanent and interim positions)

Chief Investment Officer, Chief Accounting Officer, Vice President of Finance, Vice President of Accounting, and Corporate Controller recruitment

Nationwide and international CFO executive searches

Why work with CFO Search?

CFO Search is unique in offering a 100% contingency-based recruiting option, ensuring clients only pay if the perfect candidate is provided. With an extensive network of well-qualified CFO and finance executive candidates, CFO Search guarantees exceptional service and results, backed by a rigorous interview process and high client satisfaction.

8. Vell Executive Search

Vell Executive Search is a retained executive search firm specializing in CFO and finance executive recruitment. With over 22 years of experience, they recruit financial talent for a wide range of roles, including private company CFOs, public company CFOs, corporate and divisional CFOs, and Audit Committee members. Vell's team has executed searches across the United States and Canada, focusing on candidates who can drive growth, navigate competitive markets, and shape strategic objectives.

Key Services:

CFO and finance executive search

Recruitment for various technology and cybersecurity roles

Board member and Audit Committee recruitment

Why work with Vell Executive Search?

Vell Executive Search is distinguished by its focused approach on CFO and finance executive roles, coupled with its extensive experience in the technology sector. Their specialized expertise ensures that clients receive top-tier candidates who are well-suited to the unique challenges and opportunities within their industry.

9. CFO Selections

CFO Selections is a retained search firm specializing in the placement of executive, senior, and middle management leaders exclusively in the areas of accounting and finance. They have a strong focus on CFO and Controller positions, and they provide comprehensive executive search services for a wide range of industries, from small, emerging companies to Fortune 500 firms, across both private and public sectors, including not-for-profits.

Key Services:

Placement of Executive, Senior, and Middle Management in Accounting and Finance

Executive Search with a focus on CFO and Controller positions

Unique process to understand business needs and find suitable candidates

Evaluation of candidates based on skills, experience, and cultural fit

Assistance in the hiring process, including interview arrangement and offer negotiation

Why work with CFO Selections?

CFO Selections is renowned for its specialization in the accounting and finance sectors, ensuring a deep understanding of the specific requirements of senior finance and accounting leaders. Their commitment to diversity, equity, and inclusion in the recruiting process supports clients' goals of creating diverse and inclusive teams. The firm's process is praised for its ability to find the ideal candidates who are not only technically skilled but also the right cultural fit for the client's organization.

10. Stone Executive

Stone Executive is a specialist executive search firm focusing on Chief Financial Officer (CFO) recruitment. They recognize the evolving role of CFOs in a globalized environment, requiring expertise in financial planning, tax, capital planning, investor relations, and strategic growth management.

Key Services:

Executive Search and Headhunting for CFO Positions

Placement of High-calibre Financial Executives

Specialized Recruitment across Diverse Industries

Why work with Stone Executive?

Stone Executive is renowned for its deep understanding of the CFO role's strategic aspects and its ability to connect with sought-after senior financial executives in the UK. Their approach is tailored to meet the unique needs of their clients, leveraging an extensive network and industry knowledge to identify and recruit talented CFO candidates.

11. Harvest CFO

Harvest CFO specializes in the recruitment of CFOs for private equity portfolio companies. Based in Tampa, Florida, the firm offers both permanent and interim CFO recruitment services across the United States. Harvest CFO is recognized for its deep subject matter expertise, extensive network of successful PE portfolio company CFOs, and a highly efficient executive recruiting process.

Key Services:

Executive search for permanent and interim CFO roles in private equity portfolio companies

Comprehensive recruitment process from initial assessment to successful placement

Specialized in various industries and highly niche verticals

Why work with Harvest CFO?

Harvest CFO's expertise lies in understanding the unique financial leadership needs of private equity portfolio companies. Their rigorous and collaborative process, coupled with an extensive network of qualified candidates, ensures the delivery of CFOs who are not only skilled financial leaders but also effective business partners.

12. Spencer Stuart

Spencer Stuart is a leading global executive search and leadership consulting firm, established in 1956 and headquartered in Chicago, Illinois. With a presence in over 70 offices across more than 30 countries, the firm specializes in assisting organizations across various industries in identifying and developing senior leadership talent. Spencer Stuart's services encompass executive search, board recruitment, CEO succession planning, and leadership assessment, aiming to enhance organizational performance and culture.

Key Services:

Executive Search

Leadership Assessment

Succession Planning

Onboarding Support

Team Effectiveness Consulting

Why work with Spencer Stuart?

With over six decades of experience, Spencer Stuart combines deep industry knowledge with a global network of consultants to deliver tailored leadership solutions. Their commitment to understanding the evolving dynamics of the financial sector ensures that clients receive strategic insights and access to exceptional talent, enabling them to navigate complex challenges and achieve sustainable success.

Key Factors to Consider When Choosing a CFO Recruiter

When selecting a CFO recruiter, headhunter, or executive search firm, it's crucial to take into account various factors that can significantly impact the success of your executive search:

Expertise in Finance and Executive Search: Look for recruiters with a deep understanding of the finance sector and a track record in executive-level placements

Network and Reach: Evaluate the firm’s network and its ability to access a broad and diverse pool of top-tier candidates

Reputation and Track Record: Consider the firm's reputation in the industry and its history of successful placements, especially in roles similar to a Chief Financial Officer

Customized Approach: Assess whether the firm offers a personalized approach tailored to your company's specific needs and corporate culture

What CFO Recruiter Will You Choose?

The right CFO recruiter, headhunter, or executive search firm can lead to the successful placement of a Chief Financial Officer who not only brings essential financial expertise but also aligns with your company's strategic vision and culture.

Remember, the best choice will be one that understands the nuances of your industry, shares your commitment to excellence, and is dedicated to finding a candidate who can contribute significantly to your organization’s success.