Top 11 M&A Recruiters, Headhunters, & Executive Search Firms

In the fast-paced world of mergers and acquisitions, finding the right talent to drive your deals forward can be the difference between success and missed opportunities.

That's where expert M&A recruiters, headhunters, and executive search firms come into play.

These firms specialize in identifying and placing top-tier professionals who can navigate the complexities of M&A transactions.

In this listicle, we'll delve into the top 11 M&A recruiters and firms that excel in connecting businesses with the talent they need to thrive.

TL;DR: Top 4 M&A Recruiters and Headhunters

Alpha Apex Group: Alpha Apex Group is a distinguished executive search firm in the M&A sector, expertly connecting firms with top-tier M&A talent skilled in navigating transaction complexities, driving value creation, and leading successful integration, backed by a deep understanding of strategic needs and a global talent network.

M&A Executive Search: M&A Executive Search offers flexible access to a network of experienced professionals for cost-effective M&A expertise.

Contacts & Management: Contacts & Management specializes in facilitating the sale of German mid-cap companies to international buyers, leveraging their founder's banking background.

Hechkoff Executive Search Inc.: Hechkoff Executive Search excels in placing senior-level partners with a proven track record and a personal approach to candidate connections.

Benefits of Hiring M&A Recruiters, Headhunters, and Executive Search Firms

Hiring specialized M&A recruiters is better than hiring a generic recruiting firm, especially if you want to fill executive roles.

Firstly, unlike non-specialist headhunters, these specialized professionals have extensive networks and industry expertise. That’s how they can identify and connect you with top-tier talent that might be otherwise challenging to find.

These firms can even access passive candidates who aren’t actively looking for M&A jobs.

Their knowledge of the market trends, emerging talent, and industry-specific nuances can expedite the hiring process.

That’s not because they don’t spend the time to understand your needs.

Instead, they use their time wisely, presenting you with the best potential candidates from the get-go. This efficiency maximizes your time-based and financial resources.

Besides, M&A recruiters excel in evaluating candidates based on their qualifications and cultural fit within the organization.

This savvy ensures a seamless integration post-merger, thus saving you even more resources.

The high level of confidentiality and discretion these companies offer is another benefit that most generic recruiting firms can’t provide.

Top 11 M&A Recruiters, Headhunters, and Executive Search Firms

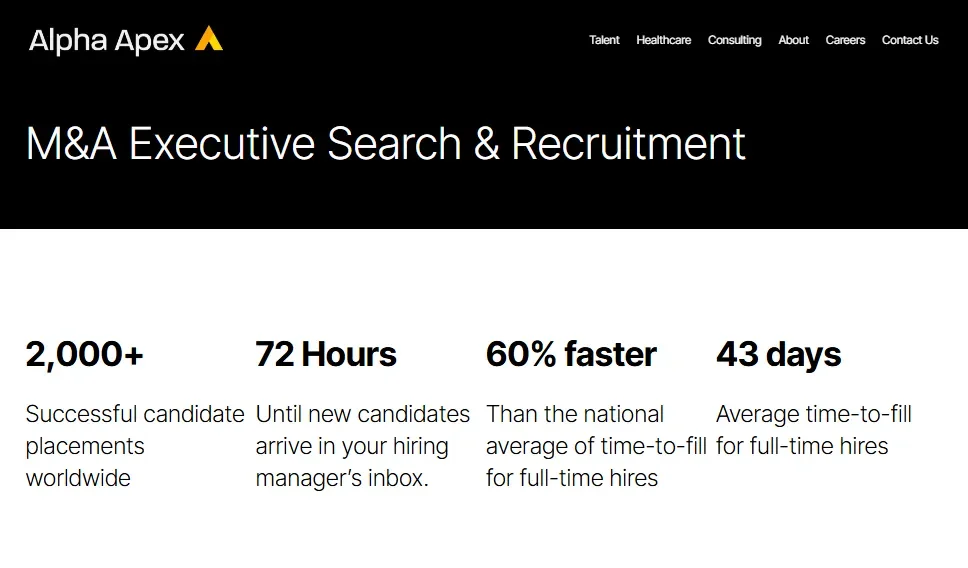

Alpha Apex Group, Leaders in M&A Recruitment.

Alpha Apex Group stands out as a premier executive search firm specializing in mergers and acquisitions (M&A), adept at connecting corporations and financial institutions with top-tier M&A talent. Their deep understanding of the complexities and strategic nuances of M&A transactions enables them to identify and attract professionals who can navigate these challenges successfully, drive value creation, and ensure seamless integration processes.

Their strategic focus on the M&A sector is matched by a rigorous candidate evaluation process, ensuring the delivery of individuals who are not only skilled in deal structuring, negotiation, and due diligence but also possess the leadership and strategic vision necessary to lead successful M&A initiatives. Alpha Apex Group's commitment to excellence and their tailored approach to executive search make them an invaluable partner for firms seeking to strengthen their M&A capabilities and achieve competitive advantage.

Key services:

M&A Executive Search: Tailored recruitment strategies to secure leading talent in M&A advisory, investment banking, and corporate development roles.

Leadership Assessment and Integration: Comprehensive evaluation of candidates to ensure they meet the strategic and cultural fit for the client, facilitating smooth integration into leadership roles.

Strategic Advisory for M&A Success: Providing clients with access to executives capable of strategic planning, execution, and post-merger integration to maximize transaction value.

Global Talent Network: Leveraging a global network to identify and attract M&A professionals with international experience and expertise.

Industry-Specific M&A Expertise: Specialized recruitment services across various industries, understanding the unique challenges and opportunities each sector presents in M&A transactions.

Why work with Alpha Apex Group?

Engaging Alpha Apex Group for your M&A executive search needs means partnering with a firm that not only understands the intricacies of M&A transactions but also possesses the network and insight to find leaders who can execute these deals successfully. Their dedication to sourcing strategic, skilled, and culturally aligned M&A talent ensures that clients are positioned for success in every phase of their transactions, from initial strategy to post-merger integration.

2. M&A Executive Search

M&A Executive Search stands out for its extensive network of experienced professionals.

They connect clients with perfect candidates. That's because they have extensive experience in major corporations, consultancies, and investment firms.

Plus, they’re a cost-effective alternative to traditional consultancies.

The firm provides flexibility in hiring options, whether full-time roles, interim positions, or targeted projects.

Industries: Aerospace, Building Materials, Construction, CPG and Consumer Products, Electronics, Food, Manufacturing, Government, Medical Devices, Oil & Gas, Pharmaceutical, Printing, Software / IT, Textile, Transportation

Notable clients: President of Minco Products, Engage Technologies, Chairman Flagship Bank, Spectrum Plastics Group

Key services:

Retained Executive Search

Fractional/Interim Leadership

Expert Project Consulting

Executive Roundtables

Outplacement Services

Mergers and Acquisitions

Why work with M&A Executive Search?

Choose M&A Executive Search for flexible access to a vast network of experienced professionals and cost-effective solutions.

3. Contacts & Management

Contacts & Management is a well-established recruitment agency with a unique specialization in M&A and a strong focus on facilitating transactions involving German mid-cap companies and international buyers.

Founded in 1992, the firm's expertise in this niche area is complemented by the founder's background in banking.

Contacts & Management's commitment to sharing knowledge through seminars and publications reflects their dedication to M&A expertise.

Their experience and connections make them a valuable choice for businesses seeking opportunities in the M&A market.

Industries: IT, Machine Building, Electronics, Medical, Biochemistry, Chemistry, Construction, Financial

Key services:

Mergers & Acquisitions

Sales Partner Search

Different Types of Recruitment

Advertising Recruitment

Direct Search Recruitment

Payroll Services

Why work with Contacts & Management?

Work with Contacts & Management if you're looking to sell German mid-cap companies to international buyers, leveraging their founder's banking background and deep M&A experience.

4. Hechkoff Executive Search Inc.

Hechkoff Executive Search Inc. specializes in senior-level partner placements.

In fact, this executive recruiter focuses exclusively on this segment of the talent pool.

They also have a vast track record with blue-chip clients, including professional services firms and Fortune 500 corporations.

These results mean they’ll be able to identify and engage exceptional candidates for your company.

Another unique trait is their talent for connecting with qualified candidates personally.

And they do it even when those candidates aren't actively seeking new opportunities. That gives you access to a vast pool of passive candidates.

Plus, understanding candidates' goals and concerns allows them to go beyond surface-level credentials.

That’s how they can find ideal matches for companies like yours.

Industries: CPG, Media & Entertainment, Energy and Industrials, Retail, Life Sciences, Healthcare, Technology, Financial, Law

Key services:

M&A Advisory

Corporate Restructuring

Consulting

Legal

Strategic Communications

Why work with Hechkoff Executive Search Inc.?

Opt for Hechkoff Executive Search if you seek a search firm specializing in senior-level partners with a proven track record and the ability to connect personally with top candidates.

5. Cowen Partners

Cowen Partners is a national executive search and consulting firm with a distinct focus on middle-market companies.

They specialize in assisting entrepreneurs throughout their business journey, from building and buying companies to selling them.

With expertise in various facets of M&A, including financial analysis, deal structuring, and negotiations, Cowen Partners aims to maximize ROI for their clients.

They have a well-established network of qualified investors, ensuring a comprehensive approach to monetizing businesses.

Industries: Software, SaaS, Construction, HVAC, Family Business, Alternative Data, CPG Products, Auto Parts, Dentistry, Real Estate, Pharmacy, Manufacturing, Healthcare, Beer and Spirits, Commercial Services, Shopify Store, Equipment Rental, Vacation Rentals, Intellectual Property, Staffing & Recruiting, Fitness & Weight Loss, IT Services

Notable clients: Starbucks, Alaska Airlines, Costco, App Annie, Dutch Bros, Beacon Communities, Nordstrom, Twin City Bank, Granite

Key services:

M&A Services

Interim Executive Services

Interim CFO Services

Board Director & Chair Search

CEO Services

Executive Compensation Analysis

Why work with Cowen Partners?

Cowen Partners offers personalized, highly skilled professionals to help you navigate every stage of your M&A journey, from analysis to negotiations, backed by their extensive network.

6. Cochran, Cochran, and Yale

Cochran, Cochran, and Yale is an experienced player in the M&A advisory space, leveraging 40 years of insight and data-driven strategies.

Their goal is to create and extract maximum value from companies by enhancing operational, human capital, and financial aspects.

They emphasize strategic support, guidance, and resources to facilitate successful business sales, mergers, and acquisitions.

With a strong track record in various industries, their expertise instills confidence in clients that their business assets are in capable hands during the M&A process.

Industries: Advertising/Public Relations, Aerospace & Defense, Agriculture, AgriScience, Biotechnology, Banking, Consumer Packaged Goods, Cannabis, Cyber, Distilled Spirits/Wine, Environmental Services, Financial, Services/Insurance

Key services:

Mergers & Acquisitions

C-Suite Executive Recruitment

Financial Leadership Recruitment

Executive & Candidate Assessment

RPO

Retained Search

Why work with Cochran, Cochran, and Yale?

With a focus on leveraging technology and providing strategic support, Cochran, Cochran, and Yale excel at creating and finding value throughout the M&A process.

7. KORE Recruiters

KORE Recruiters specializes in private equity and M&A executive search workforce solutions. This executive recruiter mostly caters to U.S.-

based organizations. They use their 25 years of experience in the field to find critical, technical, and operational talent.

Here’s what sets them apart in the recruitment industry:

They emphasize meeting industry qualifications, as well as advantageous relationships, cultural fit, growth potential, and succession potential. That’s not all.

KORE Recruiters also provides Workforce Succession Management (WSM) and Diversity, Equity, and Inclusion (DE&I) services.

All this proves their commitment to helping organizations thrive in a competitive market.

Industries: Advanced Technology, IT & AI, Engineering & Production, Product Development & Sales, Marketing & Advertising, Professional HR, Finance & Administration

Key services:

M&A Services

Executive Search Services

Direct Hire Placement Services

Workforce Succession Management

Diversity, Equity & Inclusion

Why work with KORE Recruiters?

KORE Recruiters specialize in hard-to-fill positions for US-based M&A and Private Equity organizations. They prioritize strategic recruitment strategies and diversity, equity, and inclusion.

8. Blayze Group

Blayze Group specializes in recruiting talented M&A professionals, particularly in the real estate sector.

Their unique value point lies in advising and supporting clients throughout the recruitment process to achieve specific strategic goals.

And you can rest assured the consultants at Blayze Group have a wide breadth of experience.

You’ll also like their consultative approach to finding the best fit for potential candidates and organizations.

Their focus on understanding candidates' motivations, goals, and ambitions ensures a strategic approach to finding M&A opportunities.

For your company, that means hiring people with the same values, work ethic, and goals as your brand.

Industries: Construction, Real Estate

Notable clients: CBRE, Clarion Housing, Berkeley Group, Countryside PPL, JLL, Lend Lease, Knight Frank, CREST Nicholson, Landsec

Key services:

Mergers & Acquisitions

Executive Search

HR

Reason to work with Blayze Group?

For talented M&A professionals in the real estate sector, Blayze Group's consultative approach ensures the best fit for candidates and a deep understanding of motivations.

9. GateSource

GateSource specializes in recruiting financial talent for various roles, from CFOs to corporate accountants.

Additionally, GateSource offers M&A recruitment services in North and South America.

While they can find merger and acquisition specialists in various sectors, GateSource focuses on international recruitment and interim management.

You’ll also benefit from their global perspective in the job market.

GateSource's extensive network and expertise in financial recruitment will help you find top global talent that helps your business thrive.

Industries: Mining & Natural Resources, Agriculture & Forestry, Construction, Cleantech, Engineering, Captive Insurance, Financial Services, Renewable Energy

Key services:

Corporate Finance / M&A Recruitment

Executive Search

International Recruitment

Assessment

Interim Management

Why work with GateSource?

GateSource is your choice for recruiting financial talent and providing M&A recruitment services in North and South America.

10. Burchard & Associates

Burchard & Associates offers highly personalized M&A recruitment services. And they specialize in business modeling and corporate

development professionals. With over seven decades of experience in recruitment, you can count on Burchard & Associates to

understand your firm’s needs. And find your ideal candidates.

Plus, they’re American Association of Finance & Accounting (AAFA) members.

That means they have an extensive network and effective reach in North America.

Besides, Burchard & Associates is a genuinely committed organization, which makes them a trusted partner for organizations seeking financial leadership.

Industries: Finance, Private Equity, and Family Office

Notable clients: Rex Encore LLC, Petainer Americas, The Doover Companies, Harbour Group, Alton Steel Inc., Dot Foods, Paynecrest Electric & Communications, Ben Hur Construction

Key services:

Mergers & Acquisitions and Corporate Development

Retained Executive Search

Corporate Finance

Accounting and Tax

Mergers & Acquisitions and Corporate Development

Why work with Burchard & Associates?

Burchard & Associates offers personalized M&A recruitment services focusing on corporate development and business modeling.

11. Pearse Partners

Pearse Partners specializes in recruiting for various corporate finance roles. You can count on them for Mergers and Acquisitions,

Transaction Services, Valuations, and Financial Modeling positions. Yes, all positions.

Their dedicated team of Corporate Finance recruitment consultants covers all levels, from Partners and Directors to newly qualified

Associates and Executives. Plus, you can find them throughout the Western Hemisphere.

They have extensive Corporate Finance recruitment market knowledge and operate across London, Europe, and the USA.

Industries: Finance

Notable clients: Brookfield, HarbourVest, Digital Bridge, Liberty Global, Macquarie, StepStone

Key services:

Corporate Finance Recruitment & M&A

Private Equity Recruitment

Investor Relations and Fundraising Recruitment

ESG Recruitment

Why work with Pearse Partners?

Pearse Partners excels in recruiting for Corporate Finance roles, with a high-performing team providing tailored recruitment solutions and extensive industry knowledge.

Key Factors in Choosing M&A Recruiter, Headhunter, or Executive Search Firms

Now that you’ve read about these M&A recruiting agencies above, you probably have a hard time choosing one.

After all, they all look great on paper.

So, consider the factors below before making your choice:

Industry expertise in your specific sector

A solid network and connections within the industry

Access to hidden talent pools

It’s also wise to look at the company’s reputation and track record.

Their successful placements and client satisfaction history give you insights into their capabilities.

You should also conduct a cultural fit assessment to ensure a personalized approach to candidate matching.

That’s how you can ensure a harmonious post-M&A integration.

Obviously, transparency, ethical practices, and a commitment to confidentiality should be non-negotiable when choosing an M&A recruiter or search firm.

Which M&A Recruiter Will You Pick?

The 11 top M&A recruiters, headhunters & executive search firms above have unique value propositions.

While they all provide exceptional talent solutions, each firm has different strengths – from leveraging extensive networks to specialized industry knowledge or a personalized approach to candidate matching.

So, jot down each company’s strengths and weaknesses.

Evaluate them through the lens of your needs.

And then set strategy calls with the most accomplished headhunters to see who would be the best fit.